Australia: Benchmarking optimiser performance in the NEM (methodology)

Australia: Benchmarking optimiser performance in the NEM (methodology)

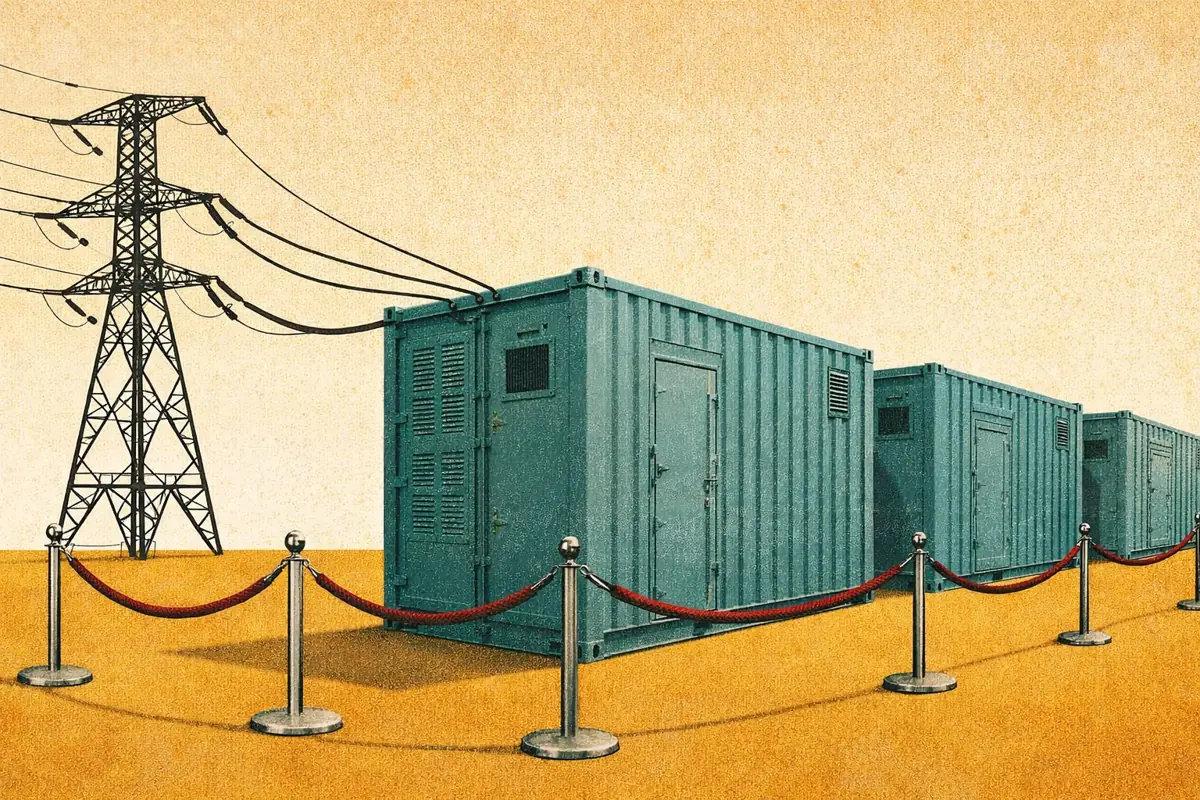

Battery energy storage capacity in the NEM is increasing rapidly, with new systems coming online across every mainland region. But as the fleet grows, so does the challenge of maximising value from each asset. Owners and developers face a critical question: who is doing the best job of optimising battery performance?

Not all batteries are created equal, and the value available to individual systems can vary significantly. This makes it difficult to compare the performance of batteries and optimisers directly.

This report introduces a new methodology to benchmark battery optimisation in the NEM. This methodology adjusts for the effects of location, contracts, and availability to focus on what optimisers can control. We then apply this to detail which batteries are earning the most value, which optimisers are leading the pack, and what project owners can do to maximise value.

The report is split into two parts, providing the following:

- Part 1 - The methodology used in measuring performance between assets;

- Part 2 - Analysis of the results, including a breakdown of asset and optimiser performance.

Executive summary

- Battery revenue performance in the NEM varies significantly - some systems captured more than double the value of others.

- A new "adjusted capture rate" methodology helps isolate optimiser performance by controlling for factors outside their control, like availability, constraints, and MLFs.

- Batteries with merchant or incentive-aligned contracts (e.g. revenue share) consistently outperform those with longer-term fixed revenues.

- Third-party ‘autobidder’ providers support optimisation of the top individual battery performers, but also have systems that underdeliver.

- Optimisation strategy, contract design, and availability are critical to maximising NEM battery value.

Part 1: The methodology

The adjusted capture rate attempts to adjust for the impact of factors outside the control of the optimiser. Those factors broadly fit into two categories: locational impacts from marginal loss factors and constraints, and availability impacts due to contracts or technical faults.

The starting point is the potential value available in the market, scaled by duration and accounting for efficiency losses. This is calculated from 5-minutely energy prices (assuming 1 cycle per day) and FCAS contingency prices.

This methodology means that batteries can exceed 100% capture rates, due to the following:

- Batteries perform one cycle per day (above the fleet average of 0.8) but in reality can prioritise cycles and cycle more if value is available on a given day.

- We don’t include FCAS Regulation. In reality, this is not an accessible revenue stream for most big batteries due to small size of the market.

- Assets can exceed 100% capture rates by co-optimising between services.

Step 1. Calculating maximum potential revenue

A battery’s potential revenue is based on maximum value available each day from energy trading and FCAS Contingency. The saturation of FCAS markets means that energy trading now tends to always deliver greater value for batteries. The exception are occasional spikes in FCAS Contingency prices which can see it exceeding the value from energy trading.

The calculation is summarised below:

- Trading potential - daily value based on efficiency adjusted spreads, scaled by duration (perfect foresight, 1 cycle per day).

- FCAS potential - daily average total FCAS contingency value, scaled by registered MW.

- Daily potential - maximum of the above. This means assets can exceed 100% through co-optimisation of these two services, or alongside FCAS Regulation.

2. Marginal loss factors hit batteries furthest away from demand centres

Marginal loss factors (MLFs) in the NEM account for losses on the electricity network. MLFs tend to decrease the further away from demand a system is, which subsequently causes a reduction in the value some batteries can earn from trading.

3. Constraints impact battery energy storage through local price adjustments

Constraints can reduce the value of batteries by preventing them from discharging during an interval. These constraints are applied through local price adjustments, with the resulting local price affecting how a battery is dispatched.

Our adjustments focus on when the local price drops to -$1,000/MWh or below. In this instance, the battery is completely prevented from exporting, for example with batteries near Canberra in April. We don’t adjust for other local price adjustments. These don’t necessarily prevent a battery from exporting, but do require rebidding, making optimisation harder.

4. Contracts change tradable capacity for certain batteries

Some batteries have bespoke ancillary contracts with state governments or AEMO - namely, Hornsdale Power Reserve and Victorian Big Battery. These reduce the power and energy capacity that is available for them to actively trade in the market, reducing their potential revenues.

5. Availability hits some batteries harder than others

A battery can only earn revenues whilst it is operational and available to trade. Events like local network outages can take a battery offline. However, technical issues can also reduce available power output, partially reducing availability.

Technical availability data is not publicly available. We instead use market availability and state of energy data from AEMO to calculate an availability factor for each unit. Some units such as Gannawarra have been particularly affected by partial availability, limiting the power they can trade in the markets much of the time.

Once these factors have been accounted for, we end up with each battery’s adjusted potential revenue. By dividing this by actual revenues, we calculate an adjusted capture rate that we can use to benchmark performance.