Australia: Explaining marginal loss factors in the NEM

Marginal loss factors (MLFs) in Australia’s National Electricity Market (NEM) account for losses on the electricity network. They can vary significantly from year to year and within the same state, impacting battery energy storage revenues.

This article briefly outlines the rationale for MLFs, the factors that affect them, and their key effects on batteries.

Executive Summary

- MLFs adjust generator revenues and load costs based on network losses between their location and the regional reference node.

- A lower MLF penalises generators, while a higher MLF rewards those that help reduce network losses - sometimes even exceeding 1.0.

- MLFs tend to be lower in congested areas with more generation than demand, and higher in areas of high demand.

- Batteries can receive different MLFs to generation in the same location site due to their differing charge and discharge profiles.

- MLFs can vary significantly year to year, creating revenue risk for batteries, especially in areas with significantly changing network dynamics.

What are marginal loss factors?

The NEM has five price regions, and every asset in the same region receives the same spot price. However, each state is large and has different network dynamics throughout. Both fossil and renewable generators can be in remote rural areas, and their energy needs to travel long distances on the transmission network to energy consumers concentrated in a few areas.

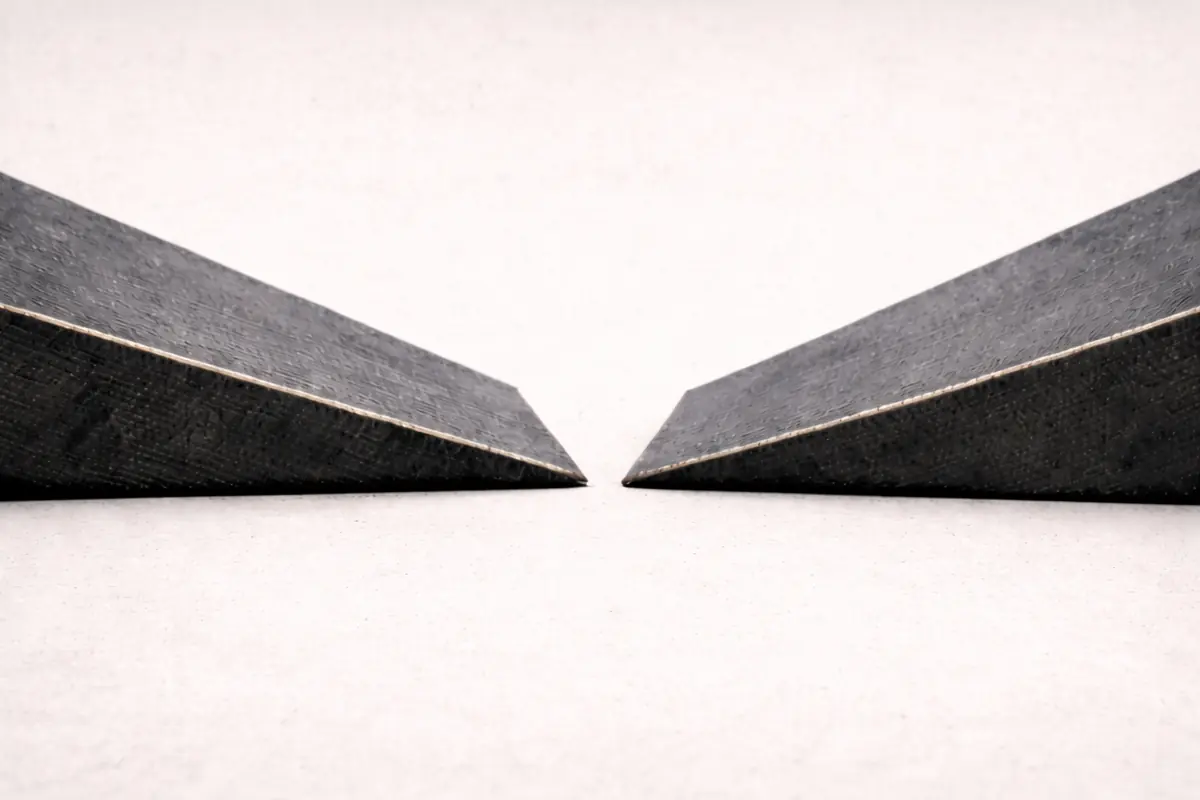

Some energy flowing through transmission lines is lost, and as more power flows down a line, the proportion of energy lost grows. MLFs represent those losses to incentivise building generation and demand in locations where they would minimise network losses.

Already a subscriber?

Log in