NEM Battery Revenues: Constraints cost NSW batteries $4k/MW in April 2025

NEM Battery Revenues: Constraints cost NSW batteries $4k/MW in April 2025

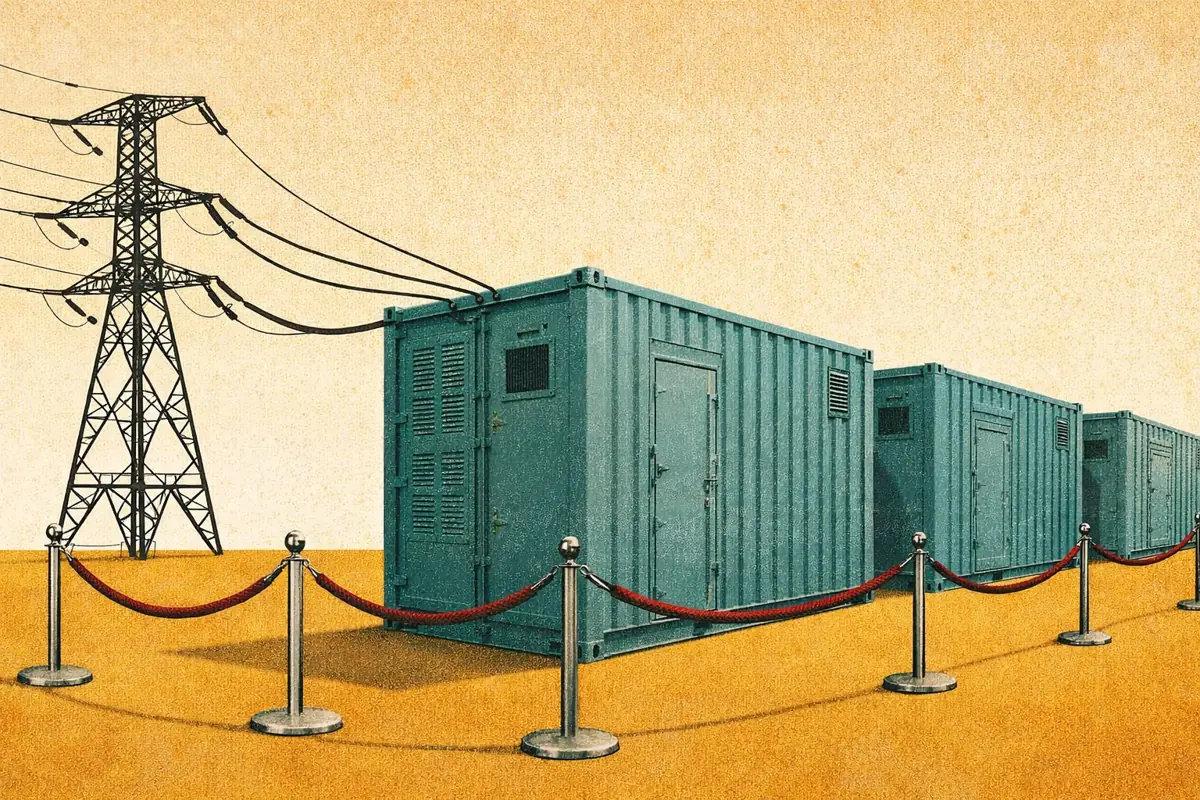

In April 2025, average revenues for grid-scale battery energy storage systems in Australia’s National Electricity Market (NEM) increased from March thanks to several intervals of extreme energy prices in New South Wales and Queensland. However, batteries had significantly varying revenues, and multiple factors resulted in underperformance.

This article provides an overview of NEM grid-scale battery revenues in April 2025: how revenues compared to previous months, the effect of energy trading and FCAS prices on earnings, revenues by state, and asset-specific factors that led to performance deviations from the index.

Find last month’s report here.

Executive summary

- NEM battery aggregate revenues in April were $82k/MW/year on average, 31% higher than in March.

- Being offline across just two days resulted in some batteries missing out on two-thirds of potential revenues for the month.

- Being constrained off for just fifteen minutes resulted in New South Wales batteries missing out on $3,800/MW of potential revenue, indicating that exposure to grid constraints can be a major factor in BESS earnings.

- In months with lower revenues (due to lower energy price volatility), FCAS can still serve as a useful revenue source (though energy trading is still dominant).

NEM-wide battery revenues increased by 31% in April, thanks to Queensland outperformance

In April 2025, grid-scale battery energy storage systems in the Australian NEM earned $82k/MW/year. Revenues increased by 31% compared to March, thanks to several intervals of extreme energy prices in New South Wales and Queensland. Energy trading revenues in April were 88% of total revenues, compared to 85% in March and 92% in February. At $73k/MW/year, energy earnings were also 37% higher than in March.

Already a subscriber?

Log in