France’s grid is shifting. Can nuclear keep up?

For years, French nuclear was seen as a steady, unchanging source of baseload power.

But as renewables expand and prices move more sharply through the day, nuclear flexibility has become part of France’s daily power balance. How much further can the fleet flex before ageing and wear start to set the limits?

If you have any questions regarding the content of this article, reach out to the author timothee@modoenergy.com.

Key takeaways

- France’s nuclear fleet has already adapted to renewables. It now flexes daily with solar, with median output swinging to 6 GW in 2025 from 1.5 GW in 2022.

- This nuclear flexibility helps, but it does not remove solar-driven volatility. Negative prices and intraday spreads are increasing.

- As midday solar grows, deeper ramping brings durability and cost into focus.

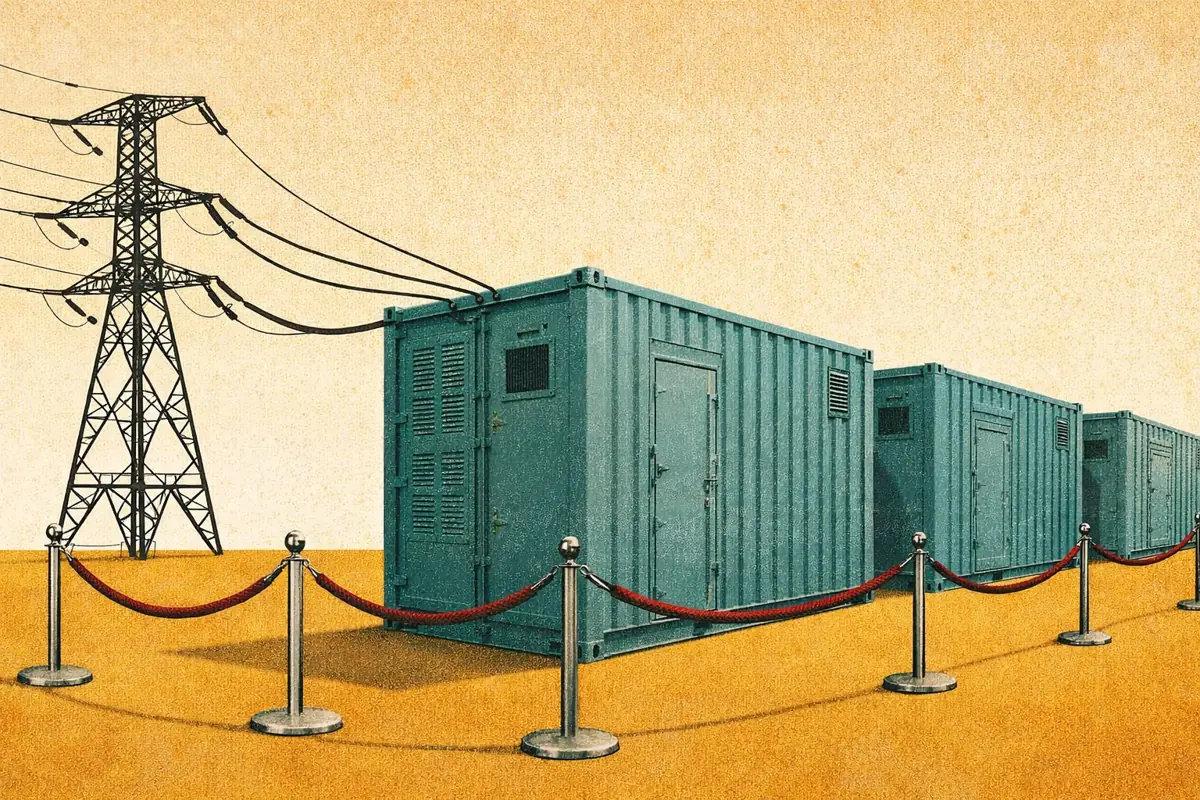

- Nuclear lifetime extensions will determine the balance of the power system. Their outcome will define the role of storage while next-generation reactors remain years away.

1. France’s nuclear intraday flexibility has become the norm

In 2025, nuclear flexibility became the norm.

Nuclear is no longer a fixed baseload source but part of the system’s daily balancing. As solar rises, reactors trim their output at midday and ramp it back up in the evening.

Daily swings in nuclear output have grown sharply, averaging 6 GW in 2025 versus 1.5 GW in 2022.

This flexibility is seasonal. Two growing trends are visible:

- Level effect is widening. Reactors run higher in winter and lower in summer, and this seasonal gap has intensified in recent years.

- Shape effect is deepening. Nuclear cuts deeper at midday as solar grows and recovers into the evening, most clearly in summer. Winter profiles remain flatter with only small midday dips.

As solar capacity and midday imports continue to expand, ramping requirements will grow. The nuclear fleet has been able to cope so far. But stronger daily ramps will continue to push the reactors further from their steady-state operation. This may start to weigh on maintenance cycles and technical longevity.

2. Nuclear flexibility is price-driven and focused on a few units

Nuclear flexibility in France is deliberate. As the national monopoly operator, EDF pilots the nuclear fleet and is able to adjust output in response to market signals.

The French Energy Regulatory Commission (CRE) estimates the nuclear fleet’s fuel-related short-run marginal cost at 8€/MWh.

In practice, cutbacks occur when prices approach or dip below zero. This suggests EDF’s modulation decisions go beyond marginal fuel cost, blending market incentives with operational strategy and constraints.

This flexibility absorbs part of the solar surplus but doesn’t eliminate the midday-driven spreads. France has had 436 negative-priced hours in 2025 so far, indicating that extreme lows are becoming more frequent, which keeps wholesale arbitrage attractive for storage assets.

Day-ahead prices and nuclear output move closely together, with generation easing as prices fall. On 10 August, output fell to 41% as the day-ahead price reached −50€/MWh.

However, this flexibility isn’t shared evenly on the nuclear fleet. EDF concentrates modulation on a group of reactors, focusing the adjustment where it’s least costly.

The Cruas plant illustrates this headroom. On 10 August, when the market showed heavy oversupply and power prices plunged to -50€/MWh, the usually steady Cruas plant reduced output, proving EDF’s ability to flex its nuclear fleet deeper.

Why do some reactors flex more than others?

Reactor flexibility reflects a cross-play of factors:

- Nuclear plants are multi-unit sites. Operators share flexibility across reactors, concentrating ramps on one unit while others hold steady.

- Near the end of the fuel cycle, reactivity margin tightens, so operators typically reduce ramp depth and frequency, as shown by the Nuclear Energy Agency.

- Grid location and redispatch role: a reactor’s geographic position in the network shapes how often it’s called on to adjust output, independently of price signals.

- Unit-specific operational and maintenance conditions can cap flexibility. For example, the stress-corrosion findings in 2022 led to a precautionary narrowing of the ramping window of affected plants.

The uneven distribution of flexibility across reactors suggests that EDF still has room to extend ramping to units that currently operate with limited modulation. Doing so, however, adds sustained ramping that increases wear and cost, pushing up nuclear’s effective levelised cost of electricity (LCOE).

Durability also becomes a concern. Studies show that deeper, more frequent ramps increase stress on ageing units, shifting the focus from daily operations to questions on how long the fleet can keep running.

3. France’s nuclear fleet is now approaching a capacity cliff

The French fleet took shape quickly in the post-oil shock years as 56 reactors came online within two decades. The result was a cheap, low-carbon power system that supplied 78% of electricity generation in 1990 and still represents 65% in 2024.

Because most capacity was added within a narrow window, many reactors are ageing in parallel. The result is a potential capacity cliff as they near retirement.

France’s current roadmap relies on keeping its existing reactors running longer. Extending lifetimes to fifty years, and beyond sixty where possible, is essential for maintaining capacity while new-generation reactors remain years away from construction.

Each ten-year extension is subject to a strict, independent review by the Nuclear Safety Authority (ASN). Deeper and more frequent flexing increases mechanical wear. This can weigh on those reviews and ultimately put lifetime extensions at risk.

In this context, capacity outcomes hinge on two variables: how far extensions can safely go across the existing fleet, and the pace and scale of the government’s EPR2 programme (next-generation European Pressurised Reactors).

Looking ahead

France’s power mix is entering a pivotal phase. As lifetime extensions progress and new-generation reactors remain distant, the balance between nuclear stability and renewable growth will define the decade ahead.

If the fleet holds, nuclear keeps prices steady, and batteries focus on reserves and grid optimisation. If ageing and deeper nuclear flexibility shorten reactor life, storage becomes essential to bridge the gap and support generation as electrification accelerates.