Is storage the missing piece in France’s power system?

Is storage the missing piece in France’s power system?

France’s electricity system is at a turning point. Long anchored by nuclear and hydro, it now faces ageing assets and rapid solar build-out that is reshaping prices and stressing grid flexibility. As the market evolves, could battery energy storage become the crucial piece that keeps the system low-carbon and reliable?

If you have any questions regarding the content of this article, reach out to the author timothee@modoenergy.com.

Key takeaways

- Nuclear and hydro keep the system low-carbon and steady. However, the nuclear fleet is ageing, hydroelectric power is at its maximum capacity, and both are entering a more uncertain phase.

- Fast-growing renewables are reshaping the intraday profile, contributing to 436 hours of negative prices in 2025. More flexibility is needed to shift noon power into the evening.

- Battery energy storage today: >1 GW online, mainly short-duration for ancillary services: prices hold but point towards maturing of the market.

- BESS tomorrow: The next battery wave is shifting toward capturing the widening day-ahead and intraday spread

1. France’s grid is shifting from nuclear to renewables, opening space for battery energy storage.

Nuclear & hydro are still the system’s backbone

France stands out in Europe for its robust low-carbon backbone, built on nuclear and hydroelectric power.

- Nuclear: In 2024, output reached 362 TWh, about 65% of supply, from 63 GW of capacity.

- Hydro adds 75 TWh from 25 GW of installed plants.

The picture contrasts with neighbouring countries like Germany, where the mix combines renewables with gas and coal.

But ageing assets combined with a solar surge are stress-testing the system

Nuclear and hydro are central to France’s system, but both are entering a more uncertain phase.

France’s nuclear fleet is ageing:

- 52 of 57 reactors are over 30 years old

- 23 reactors are over 40 years old

Hydro production has remained broadly stable, with total capacity remaining unchanged, up only 264 MW (+1.04%) from 2016 to 2025. Additionally, as the climate changes, erratic rainfall and prolonged dry spells will exacerbate seasonal volatility.

New renewables are being added to support and complement this ageing pillar.

Wind growth has stalled in recent years, held back by political resistance and higher costs, but solar has surged ahead. By 2024, solar capacity had topped 24 GW and produced 25 TWh.

2. Today’s shifts are unlocking value for battery energy storage

Solar turns midday power into a liability

Tenders backed by the Commission de Régulation de l’Énergie (CRE) have helped increase installed solar capacity by more than 5 GW in 2024.

More capacity means more frequent oversupply, which impacts the price curve. Prices drop when solar peaks, then rebound in the evening as demand rises and solar fades.

By 2025, the midday price dip reaches 45% of the average hourly price, compared to 92% in 2020.

The midday price dip translates into a sharp increase in negative-price hours. In 2024, there were 359 negative-price hours, more than double the level of 2023. The trend continued into 2025, showing clear symptoms of a flexibility gap.

With the Programmation Pluriannuelle de l’Énergie (PPE) targeting 44-52 GW of solar by 2035 (from 24 GW in 2024), midday surpluses are likely to continue growing. The flexibility gap will widen unless storage and demand response scale.

France’s central position makes solar surplus even trickier to clear

France sits at the centre of Europe’s grid with strong interconnectors on every border. Cross-border links surround the country, allowing large volumes to move in all directions when conditions permit.

Net power trade is strongly export-positive. Annually, France sends out more electricity than it takes in, reflecting a steady baseload that clears well across borders.

Steady nuclear and hydro exports are cleared abroad, especially during periods when renewables are weak. This helps importers avoid starting carbon-intensive thermal plants.

Yet around noon, many neighbours, especially Germany, are also long on solar. Surplus then has to clear inside France, and prices turn negative.

New links such as the Celtic link to Ireland (700 MW, planned for 2028) provide an outlet to a less solar-driven system when the continent is solar-long at noon.

They will help at the margin, but storage will be required to shift energy into the evening and avoid wasting clean, low-cost power.

3. From signals to profits: how battery energy storage can monetise the shift

France’s first battery wave is already operational

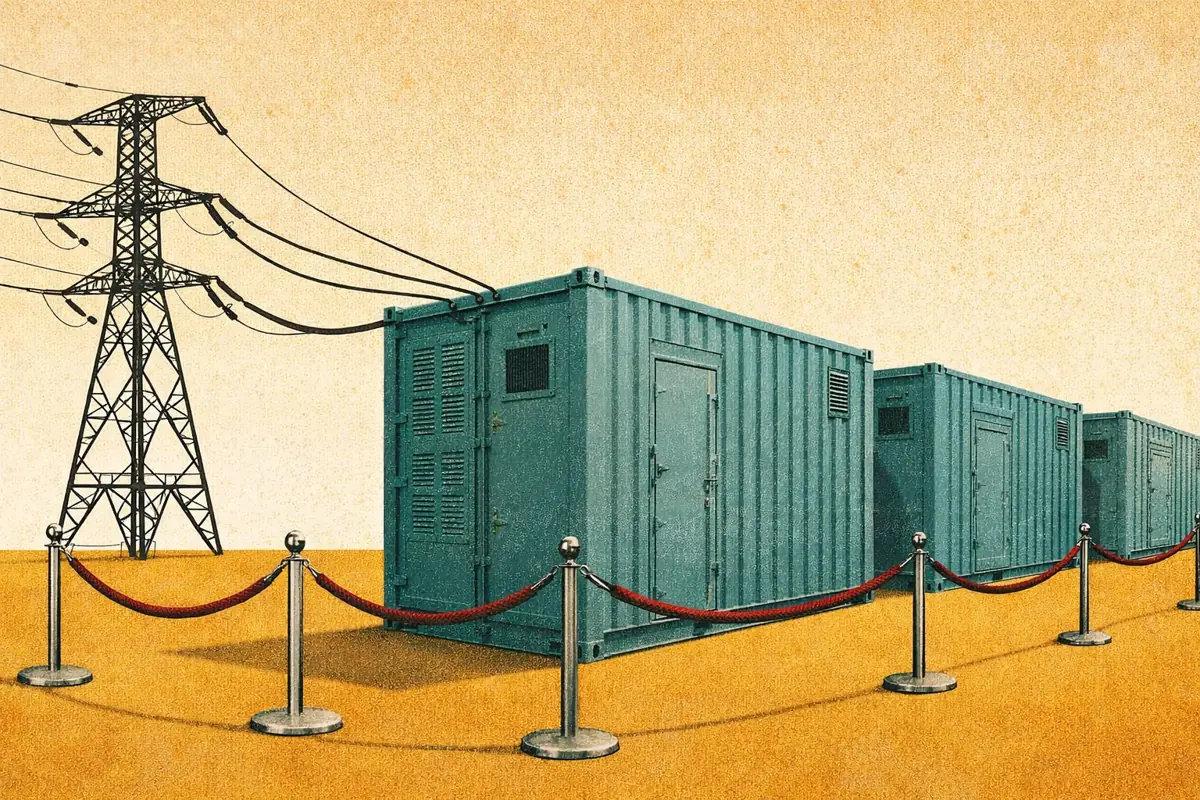

France has already passed the one gigawatt mark in operational battery energy storage systems (BESS). Installed capacity has expanded steadily since 2020.

To date, battery energy storage in France has served a focused but essential function. Most operational systems are short-duration and optimised for ancillary services, mainly Frequency Containment Reserve (FCR) and, more recently, Automatic Frequency Restoration Reserve (aFRR).

New projects are also being built with longer durations, increasing from less than one hour on average to nearly two hours by 2025.

aFRR leads today’s revenues, but the stack is set to shift

The aFRR capacity market opened in 2024 and replaced the shallower FCR market as the primary revenue stream for batteries in France.

Growing Up-Down divergence, linked with more sophisticated bidding, shows that the market is maturing and better reflecting opportunity costs.

aFRR prices remain strong for now, but as new qualified battery capacity ramps up, we expect average aFRR capacity prices to trend lower over the mid-term.

The next step: day-ahead and intraday arbitrage

As ancillary services saturate, wholesale signals are growing stronger. Batteries are increasingly able to buy when solar floods the system and sell into steep evening ramps.

Top-Bottom spreads widened further in 2025. For example, TB2 spread increased by 27% compared to 2024.

These shifts are creating more consistent arbitrage opportunities in day-ahead and intraday markets. With durations edging close to two hours, batteries are increasingly able to monetise these spreads.

Battery energy storage’s next wave is here, opening new opportunities for investors

The first wave captured value mainly through FCR and aFRR. The next is shifting toward wholesale arbitrage, complemented by stacked services.

For developers and investors, the balanced path is to monetise ancillary services today while building in optionality to pivot towards capturing widening day-ahead and intraday spreads.