Solar Cannibalisation: Why Germany’s summer glut is costing consumers

Solar Cannibalisation: Why Germany’s summer glut is costing consumers

Installed solar capacity has passed 100 GW. But peak summer demand rarely exceeds 60 GW. On sunny days, solar is flooding the market and driving prices to the floor.

The impact is already visible in merchant project economics.

But 90% of projects in Germany are backed by fixed price subsidies - and those payments are covered by the federal budget.

So what does Germany need to do to protect consumers and ensure solar is valuable to the system in the long run?

This research will explore:

- How Germany’s solar capture rate fell from 98% to 54% in under three years.

- Why summer output is growing 5x faster than in winter.

- How rising production is reshaping the merit order.

- Why Germany’s annual capture rate now matches Spain’s.

- What this means for subsidy design and storage economics.

For further information on this topic, reach out to the author - zach.williams@modoenergy.com

German solar capture rates have fallen by 44%

The solar capture rate measures the average price solar generators receive, relative to the overall market price.

In 2025 so far, that figure has averaged just 54% - down from 98% in 2022.

A clear seasonal pattern is emerging: In May and June, monthly capture rates fell to just 0.43 and 0.44.

Summer is becoming the make-or-break period for project economics.

Summer output is growing 5x faster than winter

Last year, 43% of solar output came in just three months - June, July, and August.

Germany’s high-latitude and south-facing panel design means each new gigawatt of installed capacity produces 5x more power in summer.

While midday demand has been falling by around 1 GW per year, solar output has been rising by 3 GW.

More solar is chasing less load, and covering demand more often.

This dynamic compounds the pressure on project economics:

- Solar becomes the marginal producer more often, pushing prices down.

- More energy is sold at those lower prices.

Ultimately, capture rates are falling because more energy is being sold when solar is setting the price. That’s solar cannibalisation.

Solar sets the price more often

Germany’s day-ahead market is a pay-as-cleared auction. Generators broadly bid based on their costs, and the lowest-cost bids are accepted in order until demand is met.

The market floor price is -€500/MWh. Must-run assets and subsidised renewables often bid at this level to guarantee dispatch.

In the past five years, an extra 11 GW has begun bidding at negative prices during the day.

At night, the stack looks the same as in 2020, indicating that the shift is largely driven by new subsidised solar capacity.

As installed capacity grows, solar increasingly displaces thermal generators as the marginal producer. Once the final thermal unit switched off, prices can fall sharply, by €100/MWh or more.

And the collapse is accelerating

Capture rates fell below 50% 11 times in 2022, rising to 31 in 2023, and 63 in 2024. Doubling each year.

This is not a linear progression. Each year, more solar compounds the number of days that revenue falls off the cliff.

Germany has less solar than Spain, but capture rates are just as low

Spain’s solar penetration is nearly double Germany: 18% vs 10%.

Yet, annual capture rates are nearly identical.

It comes down to seasonality and demand shape

Spain’s location closer to the equator gives it a flatter generation profile across the year than Germany’s.

Demand patterns also differ:

- In Spain, summer heat drives up air conditioning demand, helping absorb midday supply.

- In Germany, demand is flatter, with only a modest winter peak due to domestic heating.

Spain’s capture rates dip in the shoulder seasons but hold up better in summer, and even benefits from reasonable winter output, when prices are higher.

Why is Germany still building solar, even as returns shrink?

Because most solar in Germany is insulated from market signals.

Over 90% of installed capacity is backed by government support - either feed-in tariffs (FiTs) or market premiums. These schemes guarantee revenue, even when prices collapse.

Since 2017, Germany has shifted from fixed-price support to competitive auctions for most new capacity.

As auction rounds became oversubscribed, some developers have turned to PPAs or merchant exposure.

New negative price rules introduced in 2021, combined with a growing merchant share, mean that a small but increasing portion of solar is now exposed to market risk.

But, the majority of installed capacity is protected by legacy schemes - and those cost supports are covered by the federal budget.

As capture rates fall, the support gap widens.

That’s fuelling pressure for further subsidy reform, and turning storage into a central pillar of the long-term investment case.

Conclusion: Solar’s value is falling, but the case for storage has never been stronger

Germany is adding solar faster than the grid can absorb it, driving capture rates down and subsidy costs up.

With a target of 215 GW by 2030, that mismatch is only set to grow.

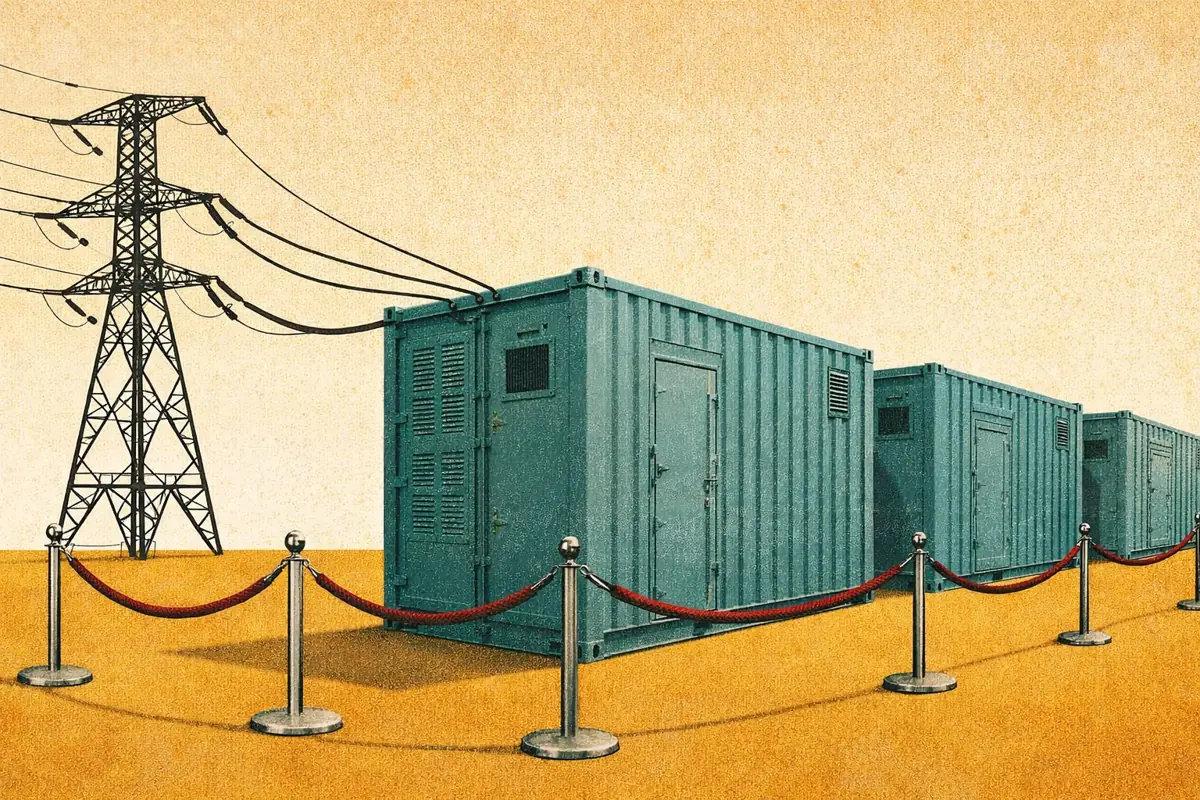

The fundamentals offer strong signals for batteries.

A grid flooded with cheap midday power creates ideal conditions for storage - shifting power to where it’s needed, cutting costs, and improving system efficiency.

That’s good for consumers - and makes a compelling business case.

Batteries can reduce subsidy payments while earning fully merchant returns, channelling private capital into Germany’s energy transition.

Battery capacity is on track to reach 3 GW by the end of the year, but that’s not enough to keep up with the scale of the solar buildout.

The question now is whether storage can scale fast enough to save the investment case for solar.