GB BESS: Why top-performing batteries earn 30% higher revenues

In H1 2025, batteries in Great Britain earned revenues at a rate of £69k/MW/year, excluding Capacity Market revenues. However, the top-performing systems earned over £100k/MW/year. These assets aren't just longer duration; they're also strategically out-earning other systems with the same specifications. So, what’s driving the higher revenues?

What sets the top earners apart?

Modo Energy subscribers get access to the full report, including:

- The revenue-maximising strategies that today’s top batteries are using

- How Balancing Mechanism dispatches are reshaping battery operations

- Why solar generation has an increased influence on revenues

- How location and seasonal patterns give some systems a revenue advantage

- The regulatory shifts that could soon impact the revenue map.

A data download of all charts is available at the end of the article.

For any further information on this topic, reach out to the author - zach@modoenergy.com

Maximising revenues without increasing cycling

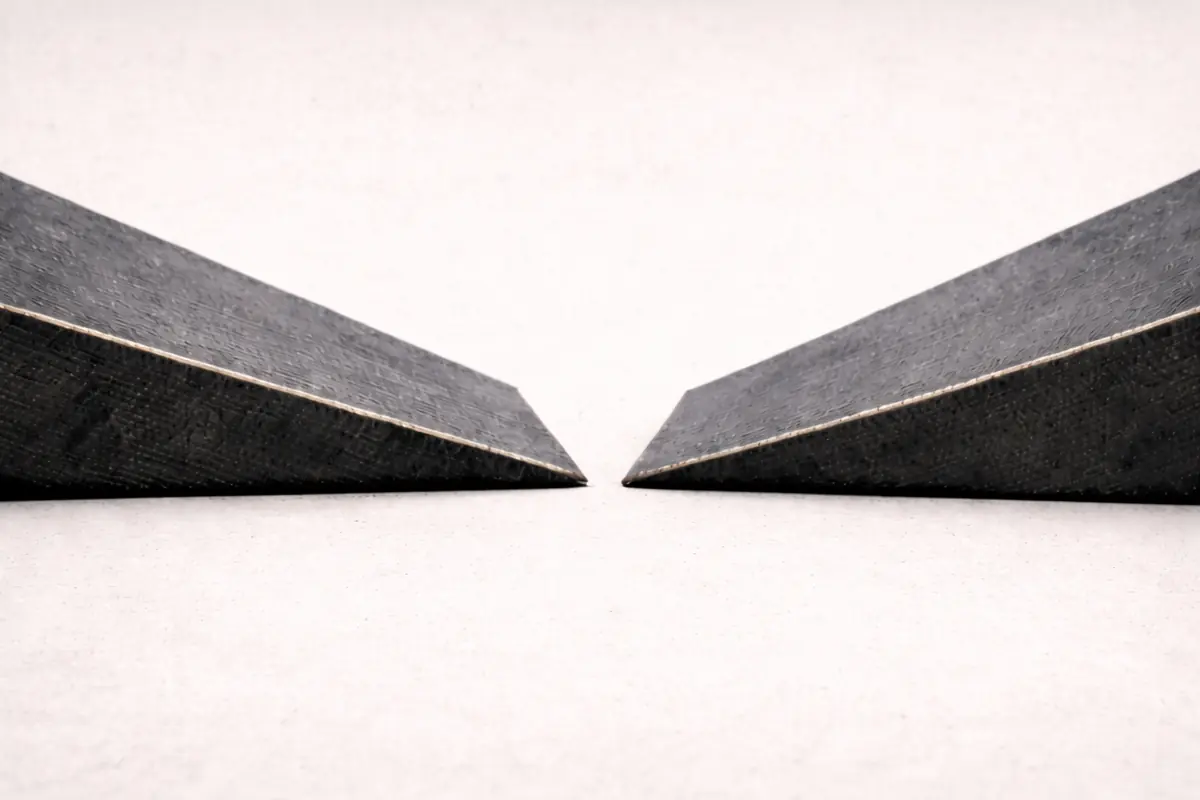

Top-performing batteries aren’t cycling harder - they’re trading smarter. By re-trading their wholesale positions in the Balancing Mechanism, they’re increasing energy sold without causing more degradation.

Two-hour batteries typically cycle 1.2 times per day. But Jamesfield 2, the highest earner in H1 2025, cycled 15% less than the lowest earner while selling 91 MWh daily, over twice its total capacity.

Already a subscriber?

Log in