CAISO: Flexible Ramping Product is tailored to BESS, but opportunity is limited

CAISO: Flexible Ramping Product is tailored to BESS, but opportunity is limited

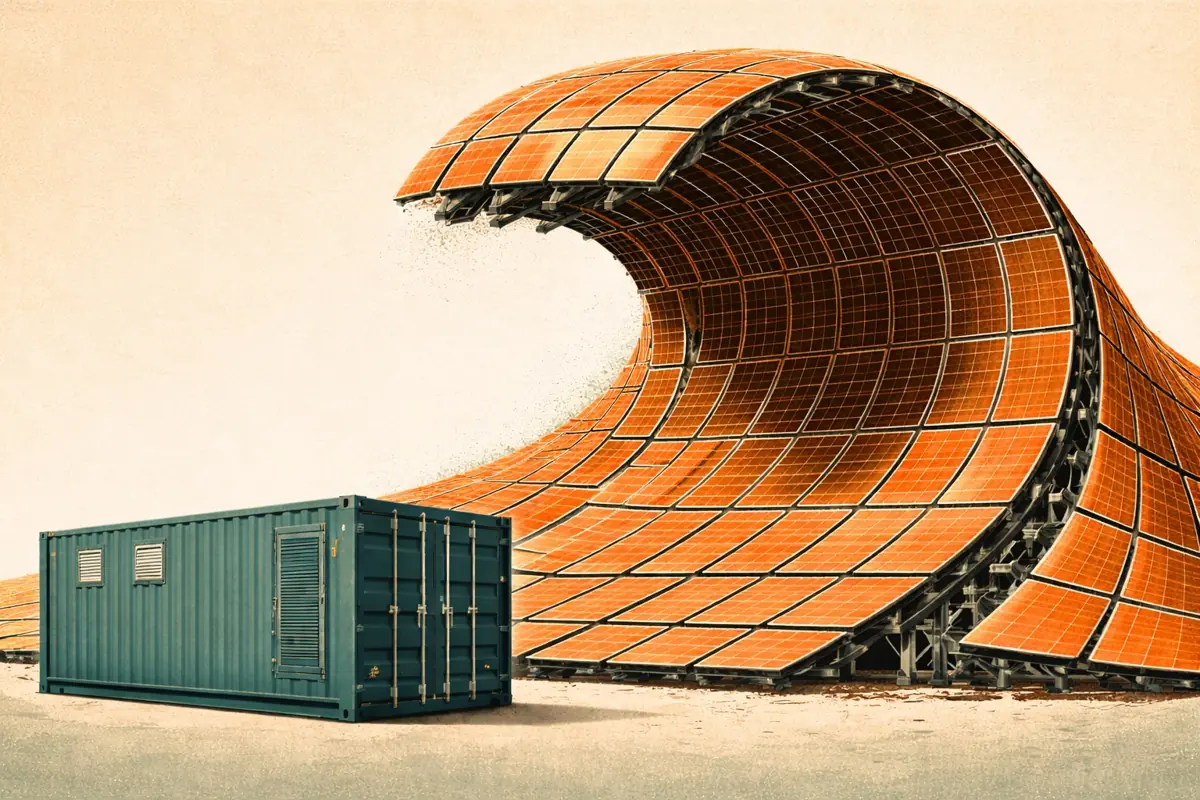

CAISO’s net load can swing more than 20 GW in a single hour. This extreme variability, driven by California’s massive solar deployment, has led the market operator to develop the Flexible Ramping Product (FRP). This novel market mechanism compensates resources for their ability to adjust their energy output rapidly in response to demand or renewable-driven uncertainty.

California’s renewable-led generation mix creates unprecedented grid flexibility and ramping needs

In 2024, solar and wind together provided 32% of the energy consumed within CAISO. This outpaced natural gas’s contribution of 28%.

The 610 GWh of solar and 268 GWh of wind energy has transformed how California’s grid operates. These resources also created new challenges that CAISO’s traditional tools, like regulation and reserve services, cannot fully manage.

California’s renewable sources can meet a significant portion of CAISO’s wholesale energy needs at essentially zero marginal cost. And their presence in the market is only going to grow: CAISO’s interconnection queue lists 1.5 GW of additional solar resources as connecting to the grid before the end of the year. Despite the recent passage of the OBBBA, the penetration of renewable generators in CAISO will continue.

Net load is the prime driver of Energy market dynamics

The large presence of renewables is why net load - total load minus solar and wind generation - is key to understanding CAISO’s markets.

Over the course of a day in 2025, CAISO’s net load typically fluctuates by 25 GW, even dipping below zero just after noon. On average, it increases 6.5 GW in the 6pm hour. This is when the sun sets, and solar generation output rapidly declines while demand is still near its afternoon peak.

The evening net load ramp has grown steeper each year as more solar capacity comes online.

The largest single-hour net load increase recorded in 2025 exceeded 20 GW. That surge packed 80% of a typical day’s net load change into just 60 minutes.

Demand variability of that size is a problem for CAISO, as dispatchable thermal generation resources need time for starting up, or ramping up and down.

The challenge surrounding this inflexibility becomes a bigger problem when forecast errors compound over time - particularly through those ramping periods, when forecasting solar output is at its most difficult. CAISO’s Flexible Ramping Product seeks to help manage that uncertainty.

Executive Takeaway

- Battery energy storage systems have unique advantages in flexibility markets: Unlike thermal generators that need time for ramping, batteries can instantly adjust output in both directions, positioning them well to capture value from CAISO's novel FRP program.

- FRP creates revenue without energy throughput: The service compensates resources simply for maintaining the ability to ramp up or down quickly, allowing properly positioned assets to earn flexibility premiums during periods of high grid uncertainty.

- CAISO faces unprecedented grid flexibility challenges: California’s net load can change by 20 GW in an hour. The size of that swing will increase over time as the number of renewable resources connected to California’s grid grows. As these changes occur, the value of providing FRP can increase too.

What is the Flexible Ramping Product?

CAISO assigns Flexible Ramping Requirements to each Balancing Area Authority (BAA) in the Western Energy Imbalance Market. In real time, CAISO then distributes those requirements to individual resources and rewards them for being able to adjust their energy output up or down

Key Features of the FRP:

- Real-time procurement: FRP assignments are made in both the Real-Time Unit Commitment (RTUC) and Real-Time Dispatch (RTD) processes.

- Directional requirements: Resources can receive both Flexible Ramping Up (FRU) and Flexible Ramping Down (FRD) awards.

- Capability-based: Awards are based on a resource’s ability to change their output, not actual Energy throughput.

- Locally-priced: CAISO launched the FRP program in 2016 and added nodal pricing in February 2023.

- No explicit bidding: Resources don’t submit separate FRP bids. CAISO bases awards on Energy market offers and physical capabilities.

How is an FRP award determined?

CAISO’s cost-minimization algorithm simultaneously optimizes Energy dispatch, Ancillary Services, and Flexible Ramping schedules. This co-optimization process determines the quantity of FRP responsibility a resource receives and the price for providing that service.

The process unfolds in two steps:

- Requirements Setting. For each RTUC and RTD market interval, CAISO assigns each BAA an FRU and FRD requirement.

- CAISO’s “Mosaic” statistical model sets the requirement sizes, factoring in current solar, wind, and demand forecasts, as well as historical forecast errors.

- Each directional requirement is then split into a “forecasted movement” and “uncertainty” segment.

- Resource Assignment. CAISO runs its real-time optimization engine.

- Generation resources receive their dispatch instruction from CAISO: their individual “forecasted movement” for that 5-minute dispatch interval.

- For each BAA, CAISO assigns generation resources their FRU/FRD responsibilities for the “uncertainty” segment based on available headroom and ramping capabilities.

- BAA-wide Flexible Ramping constraint tightness drives FRP prices, while congestion and transmission factors add local premiums.

This design makes BESS particularly well-positioned to capture FRP value. Unlike thermal generators that need time to change output, batteries can ramp up or down instantly, giving them inherent advantages in FRU and FRD procurement.

Once a resource has an FRP award, there isn’t an expectation of actual energy throughput. FRP is instead used by CAISO to provide a payment to flexible resources for reserving their headroom or state-of-charge for a later moment in time, in case it's needed as a result of ramping uncertainty.

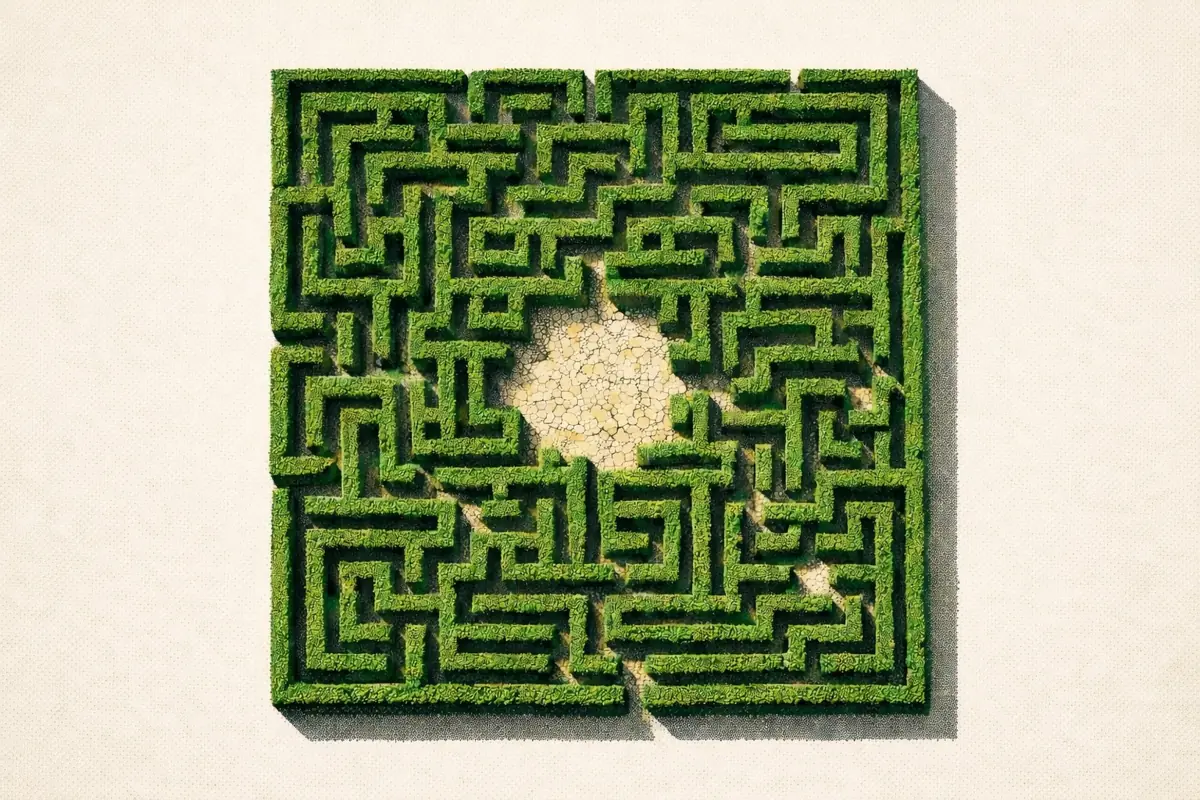

The Flexible Ramping Product rarely presents revenue opportunities for resources in CAISO

Resources do not explicitly bid to provide Flexible Ramping services, so designing a trading strategy for them is infeasible. On top of that, prices are zero in most market intervals due to more-than-sufficient flex capacity being available.

For more than 90% of nodes at which batteries are sited in CAISO, FRP prices almost exclusively clear at $0/MWh. Additionally, the instances in which the prices are non-zero tend to have limited upside - i.e., low prices - and to be relatively unpredictable.

However, for a few nodes, FRP prices regularly clear well above $0/MWh with a consistent pattern.

How can select resources capitalize on Flexible Ramping Product opportunities?

Batteries like Mordor 1 and the pair of resources at the Resurgence BESS site are exceptions to the typical FRP price profile. All three batteries are associated with other resources. Mordor 1 shares a generation-tie with the Coso geothermal project, while the two Resurgence batteries are solar-hybrid sites.

All of these resources are also in the Mojave Desert. As a result, their nodal Energy price dynamics are dominated by the region’s solar output.

This has resulted in consistent daily FRP price profiles thus far in 2025.

Mordor 1’s FRU price reached $20/MWh on average in the mornings, whereas the Resurgence BESS prices often rose above $5/MWh. Prices often stayed elevated for up to six consecutive hours.

In individual months, those prices can also rise to be on par with LMPs. For instance, on a typical April 2025 day, the FRU-Energy spread for Mordor 1 was as high as $32/MWh.

By ensuring they had a positive state of charge by the late morning and a well-designed Energy offer curve, these batteries could increase their chances of being selected for FRU provision. Here, “well-designed” means a price higher than the LMP - so the resources are not economically viable for real-time discharge of Energy - but not so high that their offer is too far down the FRU supply stack.

Flexible Ramping opportunities are quite rare, but can be meaningful sources of revenue

Predicting when these FRU-Energy dynamics will emerge is difficult, given how rare the conditions are. But when they do occur, agile operators will be able to capture revenues on par with Energy arbitrage ones, all without actually seeing any Energy throughput.

For instance, if Mordor 1 was awarded 10MW of FRU — one-half its rated power — for the hours between 9:30am and 12:30am, it could have earned $48.9/MW each day of 2025 through July 31. If it were able to secure those obligations just every other day over that same time frame, that would result in a $5.8/kW increase to its revenues.

This would represent an 21% increase over the Modo Energy BESS CAISO index through the end of July, as the average battery earned $27/kW through the first seven months of 2025.

Of course, this potential uplift represents an outlier relative to the vast majority of batteries in CAISO, and securing these obligations is far from guaranteed. However, if ramping issues continue to become exacerbated in CAISO in future years, FRP could begin to provide an alternate path to revenue for more batteries.

Why don’t other ISOs have an FRP-like product?

Every grid operator faces load uncertainty, but CAISO’s heavy reliance on solar creates particularly acute net load variability challenges.

Among the six largest ISOs in 2024, CAISO had both the largest single-hour average net load decrease - as solar comes online in the morning - and the largest net load increase - as the sun sets in the evening. Those values are -6 GW and 4.57 GW, respectively.

Fluctuations in PJM and ERCOT’s net load are close to CAISO’s in absolute terms, but those systems also have higher average loads. No other US ISO faces net load ramps of CAISO’s magnitude relative to system size.

And there is every reason to think that CAISO’s net load ramp will continue to grow steeper over time. As it does, the Flexible Ramping Product and other uncertainty-mitigation tools will likely grow in value.

The uncertainty is the reason for FRP

If CAISO’s net load changed at the same predictable pace every day, the grid operators could reliably schedule dispatchable generation to handle that demand.

But in reality, net load can swing drastically minute to minute. This means forecasts of load & renewable generation are key to a stable grid. Intermittent, geographically-concentrated generators create correlated forecast errors, making supply and demand prediction even more difficult.

And with its north-south orientation, CAISO’s solar generation peaks at roughly the same time of day across the ISO. This concentrates the periods of extreme change into small windows of time.

As renewable penetration increases, forecast uncertainty also rises, creating additional demand for flexibility services. This forecast uncertainty grows rapidly as renewables comprise a larger share of the generation mix. Small percentage errors in renewable forecasts then translate to larger absolute megawatt discrepancies that require flexible resources to balance. This could also point to the increasing benefit of providing Flexible Ramping services to the grid in the future.