Frequency Performance Payments deliver limited value to batteries in the NEM

Frequency Performance Payments deliver limited value to batteries in the NEM

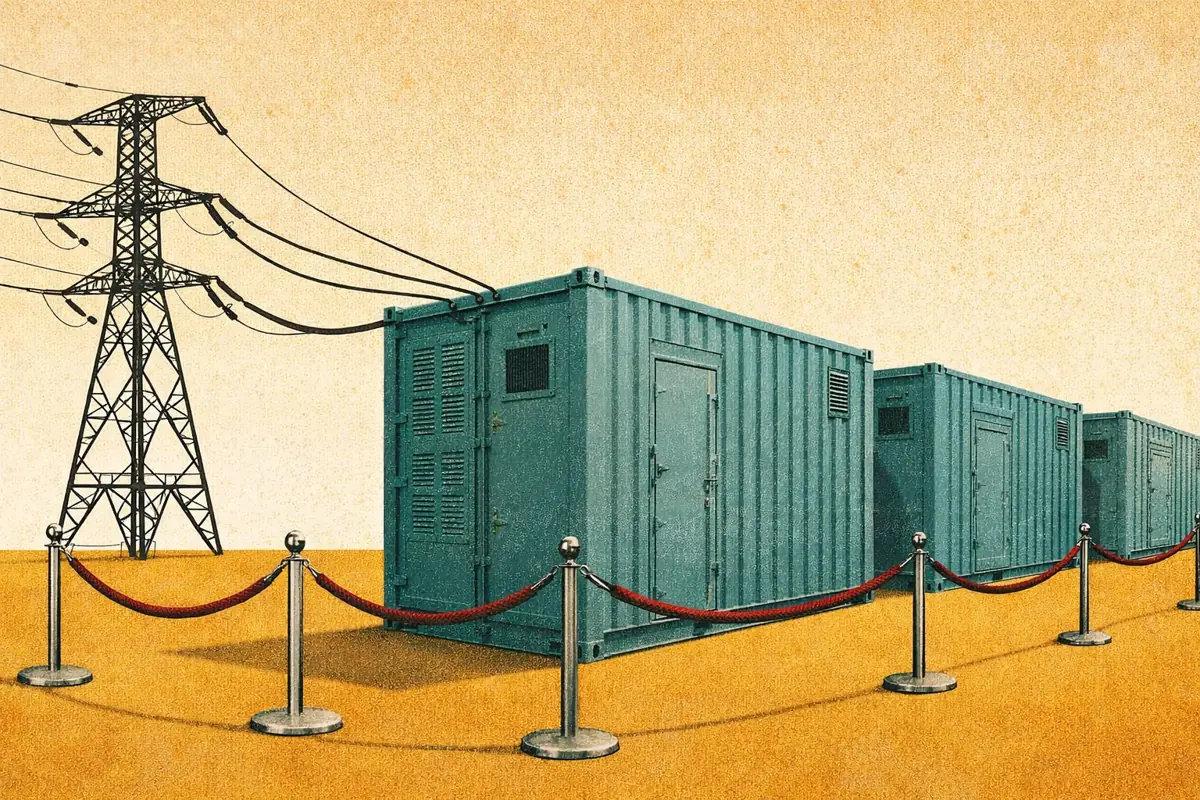

As the NEM transitions towards a renewable-based system, frequency stability has become both a risk and an opportunity. A new market mechanism is already reshaping the role assets play in maintaining it.

Frequency Performance Payments (FPP) replaced the old Causer Pays methodology for frequency deviation penalties on 8 June 2025, adding new incentives for assets to stabilise the system’s frequency.

The previous system penalised assets for deviating from their dispatch target but offered no rewards. The new two-sided FPP scheme rewards helpful frequency correction too, creating an additional revenue stream for assets. But how much value does this service generate today, and which batteries are maximising this revenue stream?

This article provides an update on Frequency Performance Payments since its inception. We break down how much the top-performing assets have earned, which technologies best provide this service, and how FPP interacts with Regulation FCAS.

Executive summary:

- Batteries lead early FPP earnings, but value remains marginal. In the first two months of the scheme, batteries earned an average of $750/MW/year. This is negligible compared to wholesale and FCAS earnings.

- FPP revenues are skewed toward Raise services. Higher Raise Regulation prices and a larger market size mean that most of the value accrues here.

- Short volatility spikes concentrate revenues. A single day delivered 21% of FPP value, showing the scheme’s value lies in days with extreme regulation prices.

- Smaller, FCAS-focused batteries earn the most FPP revenues. Smaller batteries outperform in FPP by achieving greater enablement per MW in Regulation Raise FCAS.

Batteries have earned $750/MW/year since the launch of FPP

Batteries have earned the most FPP value of any technology, but this has averaged only $750/MW/year since the scheme began. In comparison, batteries earned $157k/MW from Energy and FCAS last year, highlighting the low value of this service. Assets running FCAS-focused strategies have captured most of this value, with smaller batteries better positioned to benefit in shallow markets.

Already a subscriber?

Log in