Market Outlook

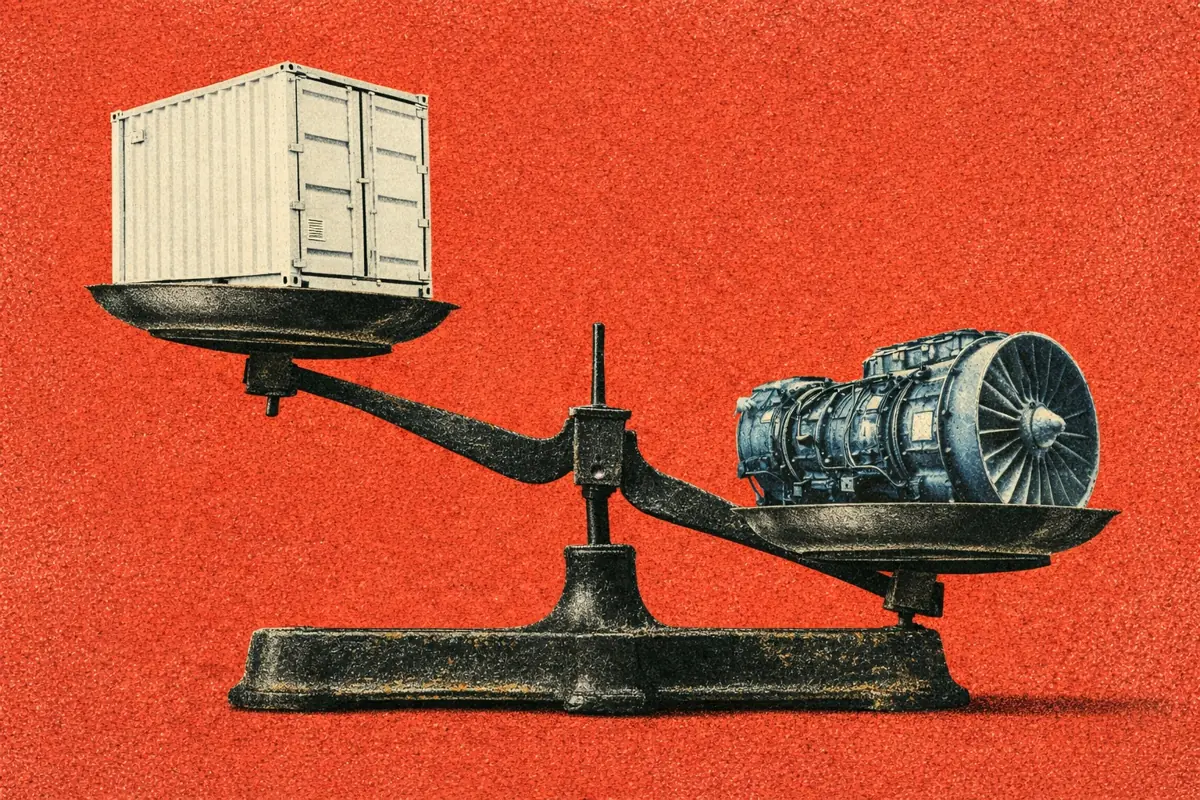

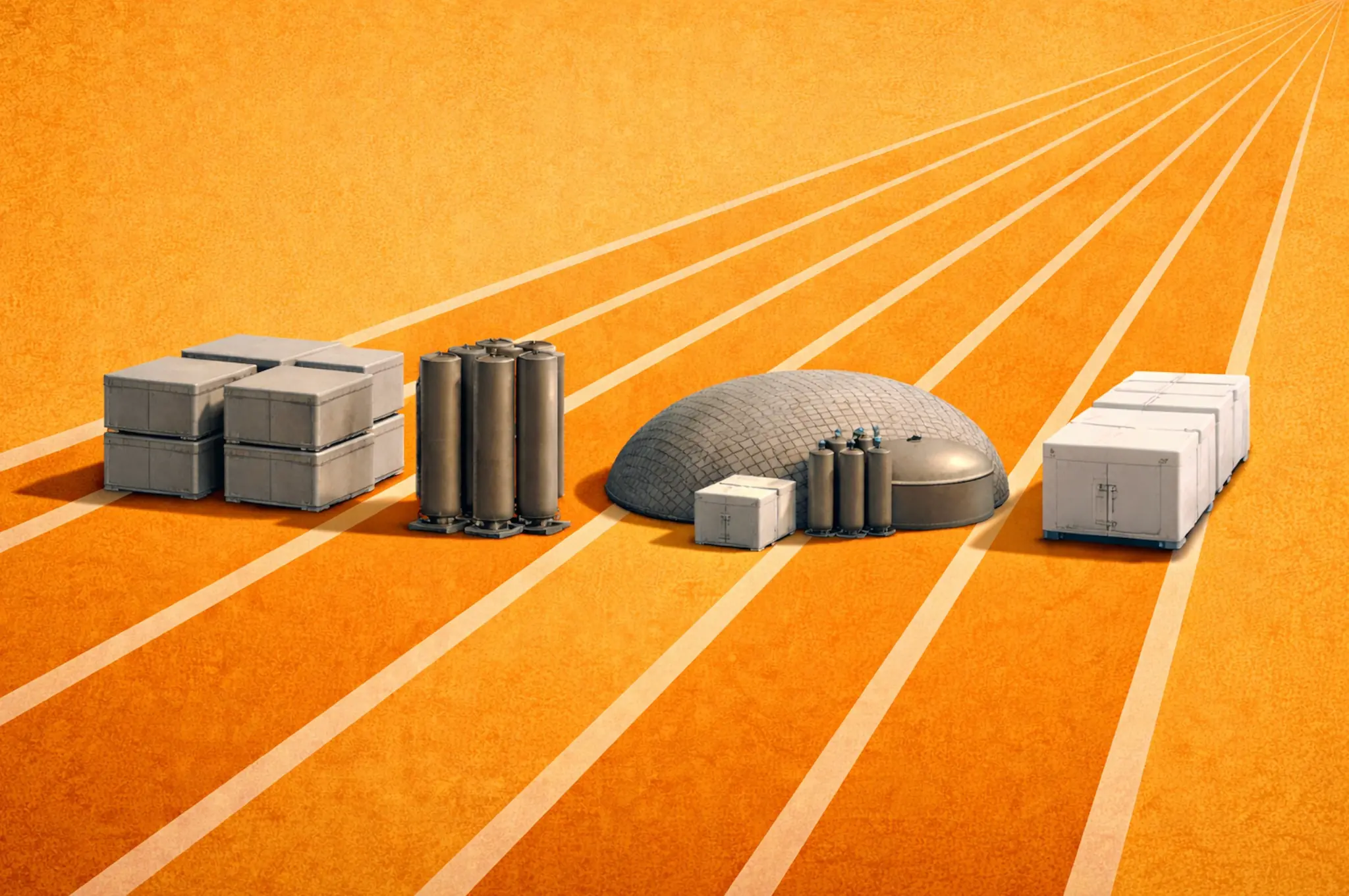

Lithium-ion retains a structural cost advantage for durations up to 8-10 hours, but beyond 12 hours, some alternative technologies (liquid-air, CO₂ batteries, iron-air) show competitive theoretical levelised costs. The 2026 tenders will determine which can transition from demonstration to commercial deployment, as the window for proving viability narrows with lithium-ion prices falling 10-15% annually.3 days ago