MACSE penalties: Swapping merchant exposure for execution risk

MACSE contracts eliminate merchant risk by guaranteeing fixed revenues. However, this certainty comes with strict obligations for both construction and performance. Failing to meet these obligations triggers financial penalties secured by bank guarantees.

Penalties apply to:

- Pre-delivery failures: projects that fail to deliver, withdraw, or face termination.

- Performance shortfalls: failing to meet requirements across energy capacity, discharge power, charge power, or efficiency.

All penalties are calculated using the Reserve Premium, the €37k/MWh/year auction price cap, while projects cleared at an average of just €13k/MWh/year. This disconnect makes penalties particularly severe relative to contracted revenues.

Failure to deliver triggers substantial penalties

Projects face penalties if they fail to deliver, withdraw voluntarily, or are terminated by Terna. Terna can terminate contracts for operational or financial breaches during the construction or delivery phases.

Penalties are calculated as committed capacity multiplied by the Reserve Premium and the two-year planning period (or one year for early withdrawal).

This structure proves particularly harsh given tight clearing margins. For a 100 MWh project, failure to deliver would lead to a penalty of €7.4 million: almost six years of contracted revenue. Operators also face dual exposure from this penalty; if the project fails, they lose their sunk costs and face the penalty.

Degradation requires active mitigation to avoid severe penalties

Once a project is online, operators face penalties if they fail to meet performance across four metrics: energy capacity, discharge power, charge power, or efficiency. Terna builds in tolerance for normal aging, allowing declared capacity and efficiency targets to decline by 1% annually.

However, batteries degrade far faster in practice. Batteries cycling 0.5 times daily see the performance gap reach around 13% by year 10, while daily cycling at MACSE's maximum of 1 cycle per day drives the shortfall to nearly 20%. These performance deficits expose operators to continuous penalties, particularly when combined with operational unavailability.

The cost of unaddressed degradation is severe. A 100 MWh battery cycling at MACSE's maximum rate accumulates approximately €45 million in penalties over 15 years, more than double the €19.5 million contracted revenue. Even at a more conservative cycling rate of 0.5 times daily, penalties reach €35 million, still exceeding contracted revenue by 80%.

Many operators oversized capacity or plan augmentation to manage this risk, though both require additional capital and compress already tight margins.

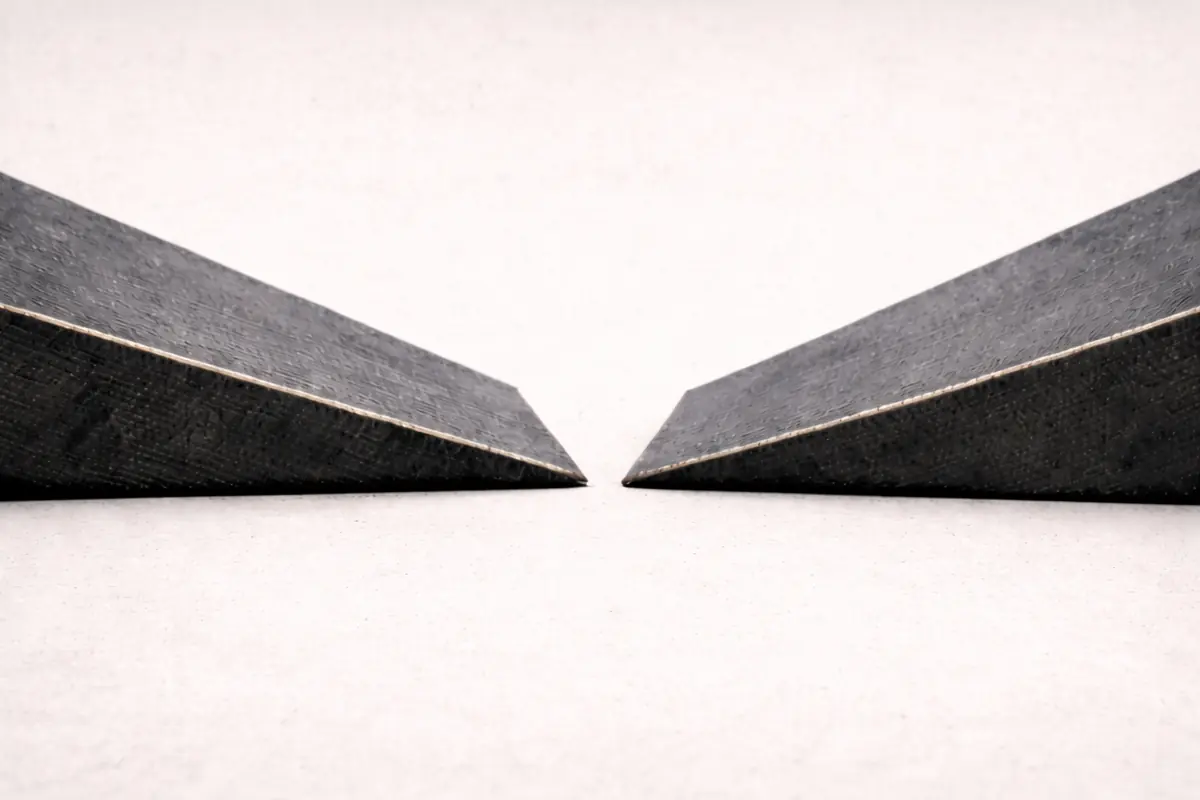

Understanding the MACSE’s penalty structure

Terna provides a buffer, but it has limits

Operators receive 7,200 penalty-free quarter-hours per five-year contract period, equivalent to 15 full days of unavailability per year, provided they give 5 days notice. This covers typical operational unavailability of around 5%, or approximately 13 days annually.

Crucially, the allowance counts proportionally for partial unavailability, meaning a battery at 90% capacity uses just 0.1 quarter-hours of allowance per quarter-hour of operation, making the buffer effective for managing slight degradation shortfalls.

Already a subscriber?

Log in