German BESS investment outlook: Risk analysis

German BESS projects deliver 12–14% unlevered IRRs. But how far can those returns fall?

A merchant battery is exposed to the power market for 20 years. Returns are heavily influenced by macroeconomic factors: gas prices, demand development, and the pace of battery buildout.

Each depends on policy decisions and geopolitics that are inherently uncertain over that horizon.

When gas falls, spreads compress. When demand disappoints or more batteries connect, the scarcity hours that drive annual returns thin out. Under the most adverse market scenario, revenues fall by 37% and IRRs compress to 5.5%.

Project-level risks compound on top. Connection terms, grid fees, and curtailment constraints vary by siƒte and by TSO. Two projects with identical market exposure can deliver very different returns depending on the terms they accept. Unfavourable connection terms alone can cut 20% from lifetime revenues.

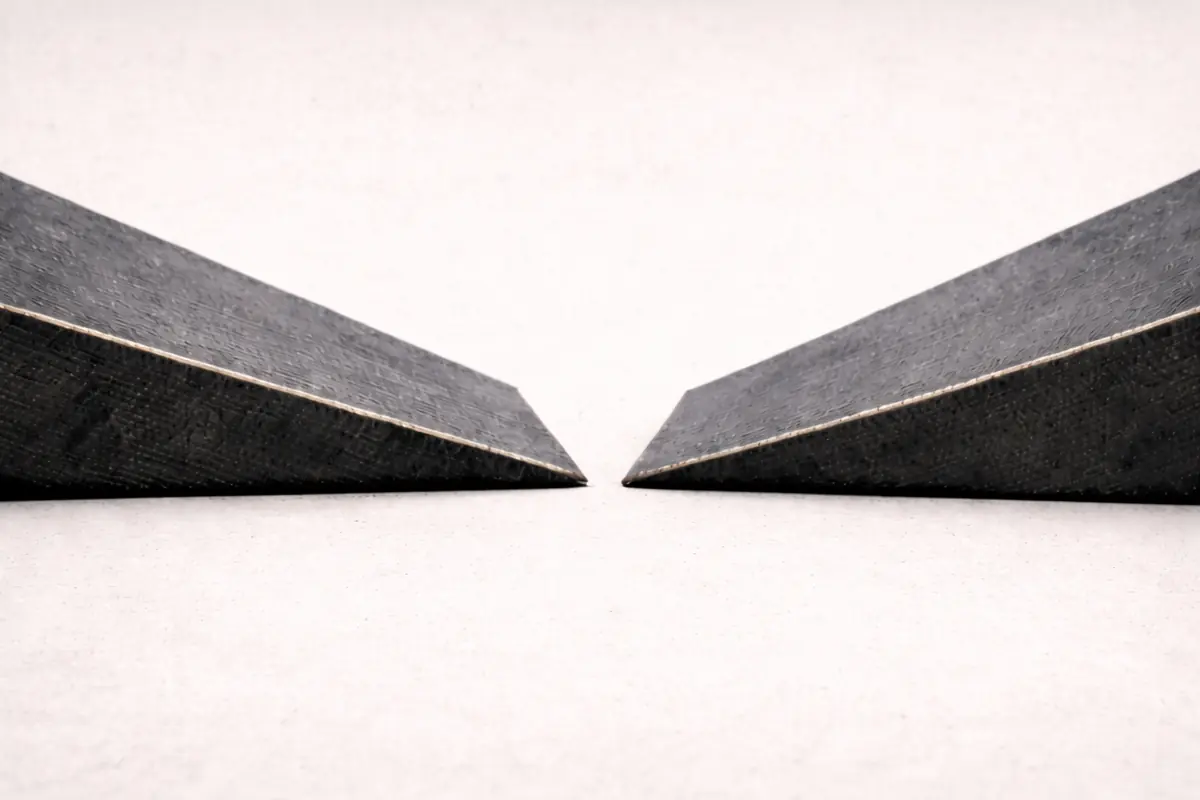

No single risk breaks the business case in isolation, but when market headwinds meet restrictive project terms, returns fall below financeable thresholds.

This article is part of Modo Energy's quarterly German BESS investment outlook, which also covers the market fundamentals and bankable routes-to-market.

Market risks

Gas and carbon prices drive the largest revenue swings

Gas-fired plants set the wholesale price in around a third of German settlement periods. When gas prices fall, peak prices fall with them.

European gas prices swung from €3/MWh in 2020 to €250/MWh in 2022 and have since settled around €35/MWh. Carbon follows gas through fuel switching: when utilities burn more gas than coal, demand for emissions permits falls.

Modo Energy’s stress test varies gas by ±50% from current levels, with carbon following at ±40%.

Already a subscriber?

Log in