Le prix de référence provisoire de la capacité en Australie-Occidentale bondit de 36 % : enseignements pour les BESS

Le prix de référence provisoire de la capacité en Australie-Occidentale bondit de 36 % : enseignements pour les BESS

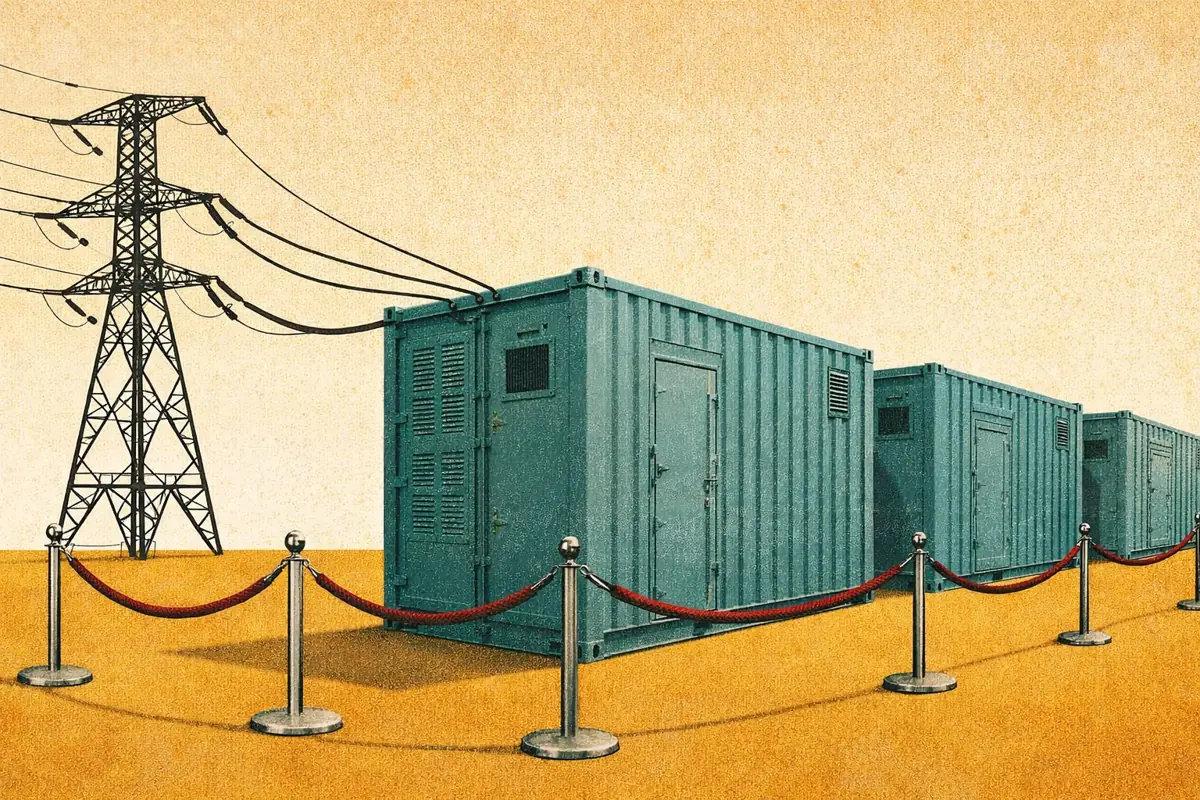

Le projet de prix de référence de la capacité de réserve (BRCP) du WEM pour l'année de capacité 2028/29 s'établit à 491 700 $/MW/an, soit une hausse de 36 % par rapport à l’an passé. Ce prix sert de référence pour les paiements annuels de capacité versés aux producteurs et aux batteries du marché. Pris isolément, cela envoie un signal fort aux projets de stockage d’énergie par batterie visant le marché d’Australie-Occidentale.

Mais le prix de référence de la capacité n’est qu’une pièce du puzzle tarifaire. Une capacité excédentaire prévue pourrait faire baisser le prix de la capacité de réserve (le montant réellement versé) à 422 372 $/MW/an.

Cet article détaille les facteurs ayant conduit à la hausse de 36 % du prix de référence, explique comment la logique d’excédent de l’AEMO réduit le prix de 14 % sous le seuil, et les points d’attention pour les développeurs souhaitant intégrer le mécanisme.

Résumé exécutif

- Le projet de prix de référence de la capacité augmente de 36 % pour atteindre 491 700 $/MW/an. Cette hausse s’explique par une exigence de capacité sur 6 heures, l’augmentation des coûts de construction et une « charge fixe de capital » de 100 000 $/MW.

- L’AEMO prévoit un excédent maximal de 495 MW pour 2028/29. Cela exerce une pression à la baisse sur le prix, le ramenant à 422 372 $/MW/an selon les prévisions. L’augmentation réelle par rapport à 2027/28 serait alors limitée à 17 %.

- Le coût de référence de 520 $/kWh de l’ERA dépasse largement les estimations nationales de la CSIRO (301 à 377 $/kWh). Cet écart suggère que le BRCP compense plus que suffisamment les coûts de construction typiques, même en tenant compte des surcoûts régionaux en WA.

- Une batterie de 200 MW sécurisant un prix fixe sur 10 ans pourrait générer 844,7 millions de dollars de revenus de capacité. Cela constitue un plancher significatif malgré des multiplicateurs réduits. Cependant, le prix fixe implique une perte de priorité d’accès au réseau et d’éventuels gains futurs.

De 360 000 $ à 491 000 $ : ce qui a changé dans le modèle de prix de capacité

Le prix de référence de la capacité de réserve représente le coût annualisé estimé d’un BESS « de référence » de 200 MW / 1 200 MWh, exprimé en $/MW/an. Pour 2028/29, l’Autorité de régulation économique (ERA) propose un prix de référence de 491 700 $/MW/an.

Sign up for free to continue reading

Join the Modo Terminal today by signing up for a free account and unlock access to exclusive content that will enhance your market understanding!Sign up for free