NEM Buildout Report: BESS capacity exceeds 5 GW in Q4 2025

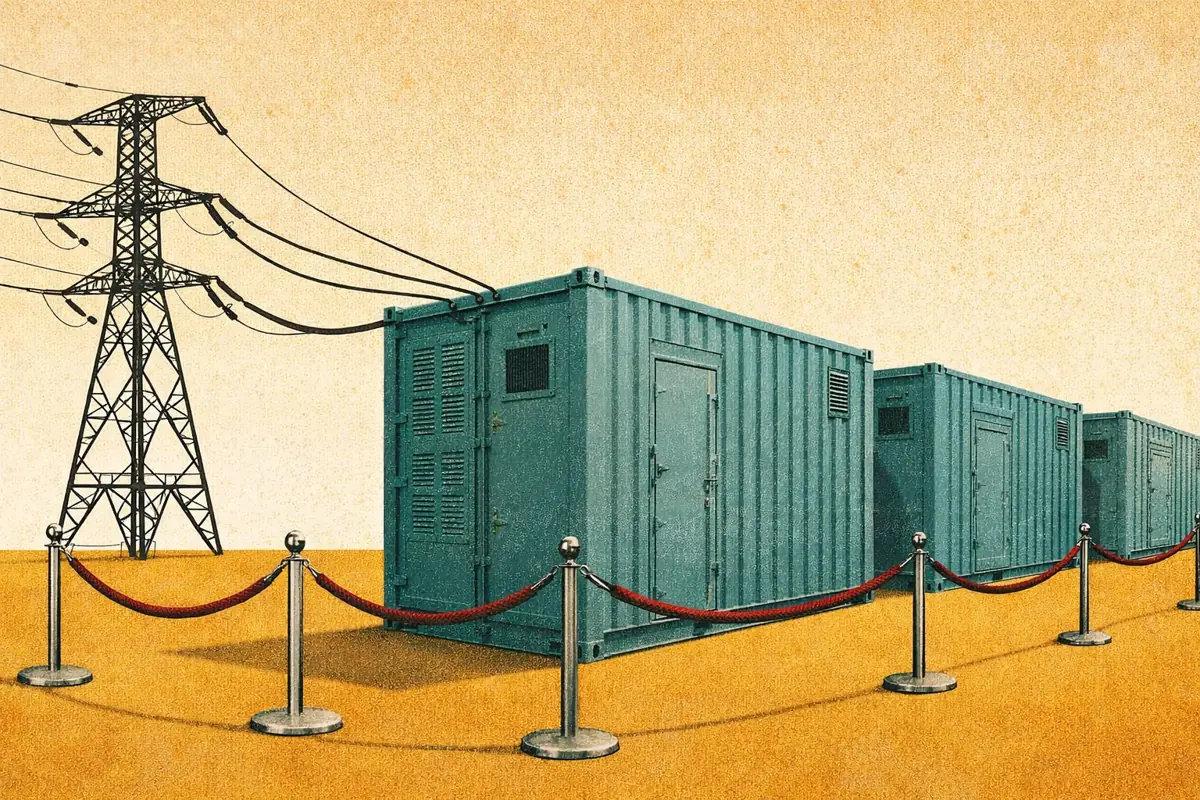

The final quarter of 2025 concluded a record year for battery energy storage in Australia's National Electricity Market. This acceleration reflects a market that has now transitioned to industrial-scale BESS deployment. Construction timelines have fallen to record lows, diverse ownership models are emerging, and a clear project pipeline exists out to 2028.

A deployment surge in Q4 more than doubled the year's capacity additions, with Queensland overtaking all other states to claim the top position despite being the last to enter the market. The quarter also brought the NEM's first 4-hour batteries online. This signals a strategic shift in how developers approach duration and revenue capture.

This article provides an update on battery energy storage deployment in the NEM, highlighting newly commissioned assets, trends in system size and duration, and what this means for our forecast through to the end of 2028.

Modo Energy subscribers can download the full pipeline dataset at the bottom of the page.

Find last quarter's report here.

Executive summary

- Q4 2025 set a quarterly deployment record with 2.2 GW and 5.2 GWh of new BESS capacity, exceeding the previous quarterly record by over two times

- The NEM's first 4-hour batteries came online in Q4 2025, pushing average fleet duration above 2 hours for the first time

- Queensland overtook South Australia, Victoria, and New South Wales to become the state with the most operational BESS capacity at 1.86 GW

- Several projects achieved construction timelines under 12 months, with Smithfield completing in 7-8 months and Ulinda Park in 10 months

- The BESS pipeline now projects 18.7 GW of operational capacity by end of 2028, an increase of 1 GW from the previous quarterly forecast

What BESS projects came online in Q4 2025?

The quarter's deployment pattern reveals a maturing market. Ten projects from eight different developers came online, ranging from utility-owned assets to independent players. This diversity in ownership reflects increasing confidence across the sector, with different participants pursuing distinct revenue and contracting strategies. The first two batteries with contracts came online, while half the new projects are not backed by long-term offtakes.

Download

Already a subscriber?

Log in