Australia: Battery non-conformance and its cost

Dispatch instructions in the National Electricity Market are binding and issued every five minutes to balance supply and demand. Compliance with those instructions underpins system stability.

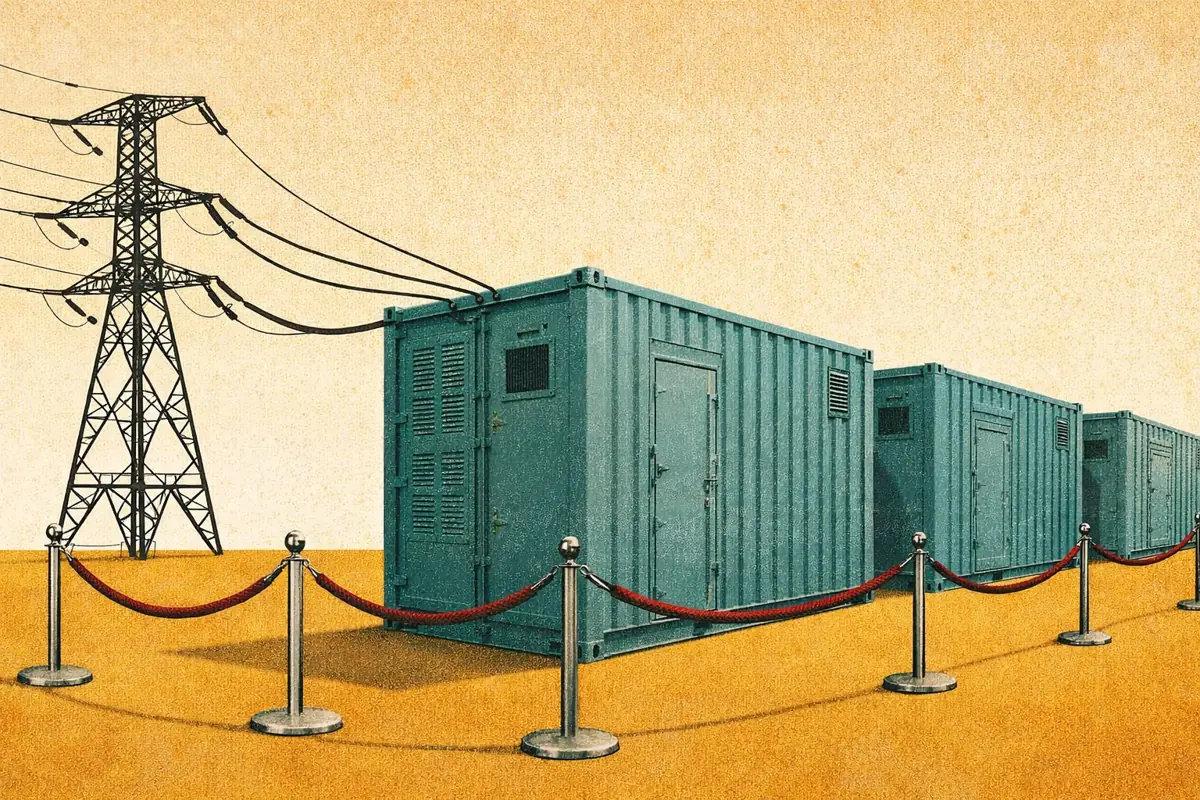

In practice, deviations occur. Assets can move outside AEMO’s conformance thresholds due to control tuning, response to system conditions, forecast error, or commissioning behaviour. When this happens, AEMO declares the unit non-conforming, applies a unit-specific constraint, and re-optimises the market around its actual output. The event is published as a market notice.

Non-conformance is not unusual, particularly during commissioning. As new storage capacity enters the market, aggregate notice volumes are increasing, reflecting elevated event rates in the first year of operation.

However, the NEM does not impose an automatic penalty for missing dispatch. The only structured financial mechanism linked to deviation is Frequency Performance Payments (FPP), which assesses whether your output helped or harmed frequency restoration, not whether you followed your dispatch target. Energy non-conformance itself carries no dedicated in-market penalty.

This article examines which technologies account for most non-conformance events, how behaviour changes over an asset’s life, and how the costs created by these deviations are allocated across the market.

Contact the author at marcus@modoenergy.com

Executive summary

- Dispatch non-conformance is becoming more common as the generation mix changes, driven by ageing coal units and commissioning-phase behaviour in new assets.

- Coal accounts for the largest share of notices overall, but batteries record the highest number in the most recent year as new capacity enters the market.

- Non-conformance is most frequent in an asset’s first year of operation, with event rates falling sharply after commissioning.

- Most events occur at low prices and have limited financial impact, but deviations during extreme price intervals can be costly.

- Energy dispatch non-conformance carries no automatic in-market penalty. The market corrects the imbalance through FCAS, while enforcement under the National Electricity Rules remains rare.

Non-conformance varies by technology and asset maturity

Coal accounted for the largest share of non-conformance events between 2020 and 2024, responsible for more than all other technologies combined. In 2025, however, batteries recorded the highest number of notices, a consequence of . Batteries often miss their dispatch targets during testing as operators calibrate control systems, tune bidding algorithms, and verify response times against AEMO's dispatch signals. These deviations typically resolve once commissioning is complete.

Already a subscriber?

Log in