2026 Capex: How much does it cost to build a battery in Australia?

2026 Capex: How much does it cost to build a battery in Australia?

Capex remains pivotal to the investability of grid-scale batteries in Australia. More than 16.5 GW of projects have passed final investment decision across the NEM and WEM since the commissioning of the first large-scale battery in 2017. At that scale, build cost assumptions directly influence which projects proceed.

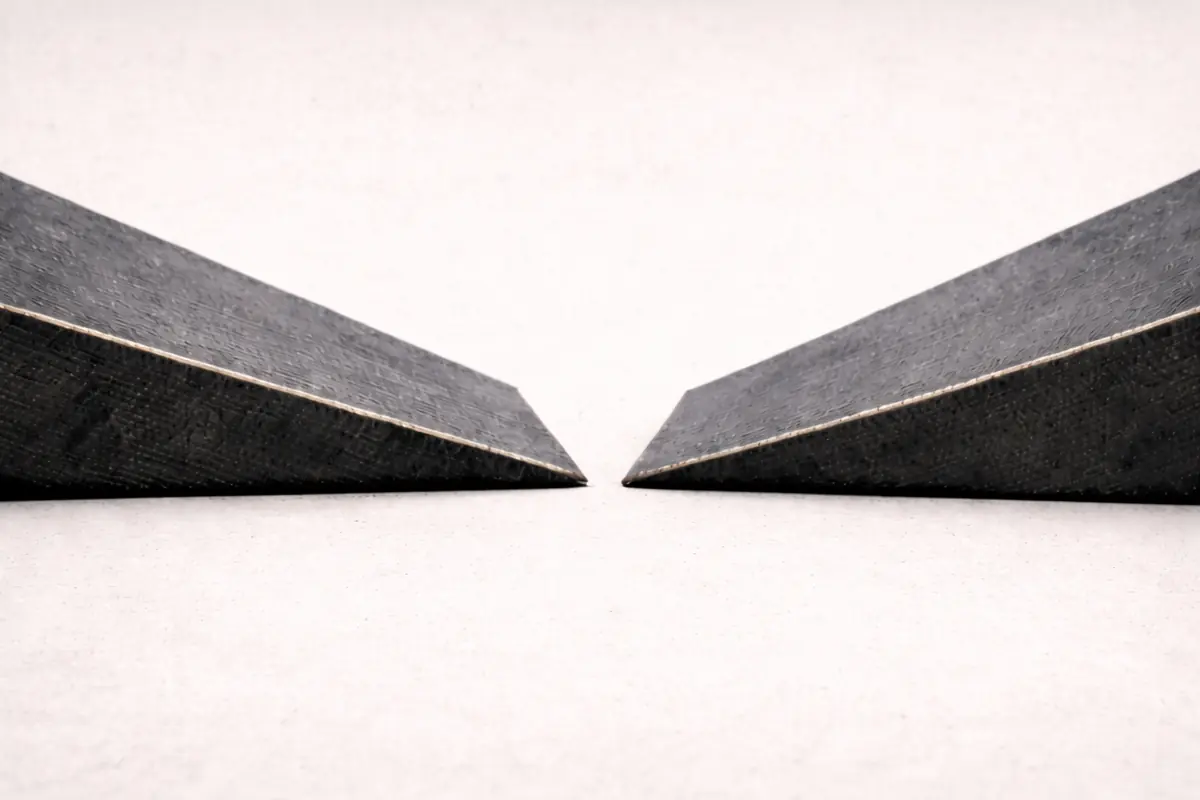

On an energy basis, batteries are 50% cheaper since the first battery was installed. Capex per kilowatt-hour has fallen as containerised systems have become cheaper. Yet, capex per kilowatt of installed power capacity has remained relatively flat. Declining energy costs have allowed projects to shift toward longer durations for a similar overall cost.

The latest GenCost 2025–26 update projects battery capex to continue declining over the coming decade. Our forecast builds on that release, incorporating recent pricing data and updated cost assumptions to assess how those declines are likely to unfold in Australia.

This report analyses historical and projected capex for grid-scale batteries in Australia. We assess differences across states, contrast the NEM and WEM, and break down capex declines by component cost.

Executive summary

- Battery energy capex has fallen from $990/kWh to $480/kWh, but capex on a power basis has stayed flat. Longer-duration systems have absorbed much of the hardware cost decline.

- Near-term capex reductions are driven primarily by lower battery costs as the China–Australia pricing gap compresses.

- Developers should focus on areas with competitive balance-of-plant and labour costs, which make up a larger share of long-term total capex.

- Victoria is the cheapest place to build a battery in 2025. Proximity to ports, a large construction workforce, and lower freight costs make it the most cost-competitive region.

- Batteries in the WEM projects have cost 67% more per kW than the NEM, with a greater premium at longer durations.

China’s battery oversupply is compressing Australian build costs

In the last three years, technological improvements and overcapacity in China’s battery manufacturing sector have pushed container prices to sustained lows. This pricing pressure is now flowing into Australia, narrowing the gap between Chinese factory prices and delivered project costs.

This compression is expected to reduce battery capex by around 10% over the next two years - continuing recent cost declines. Pricing pressure is likely to outweigh the potential short-term capex increases some analysts have flagged in response to rising lithium prices in China.

Already a subscriber?

Log in