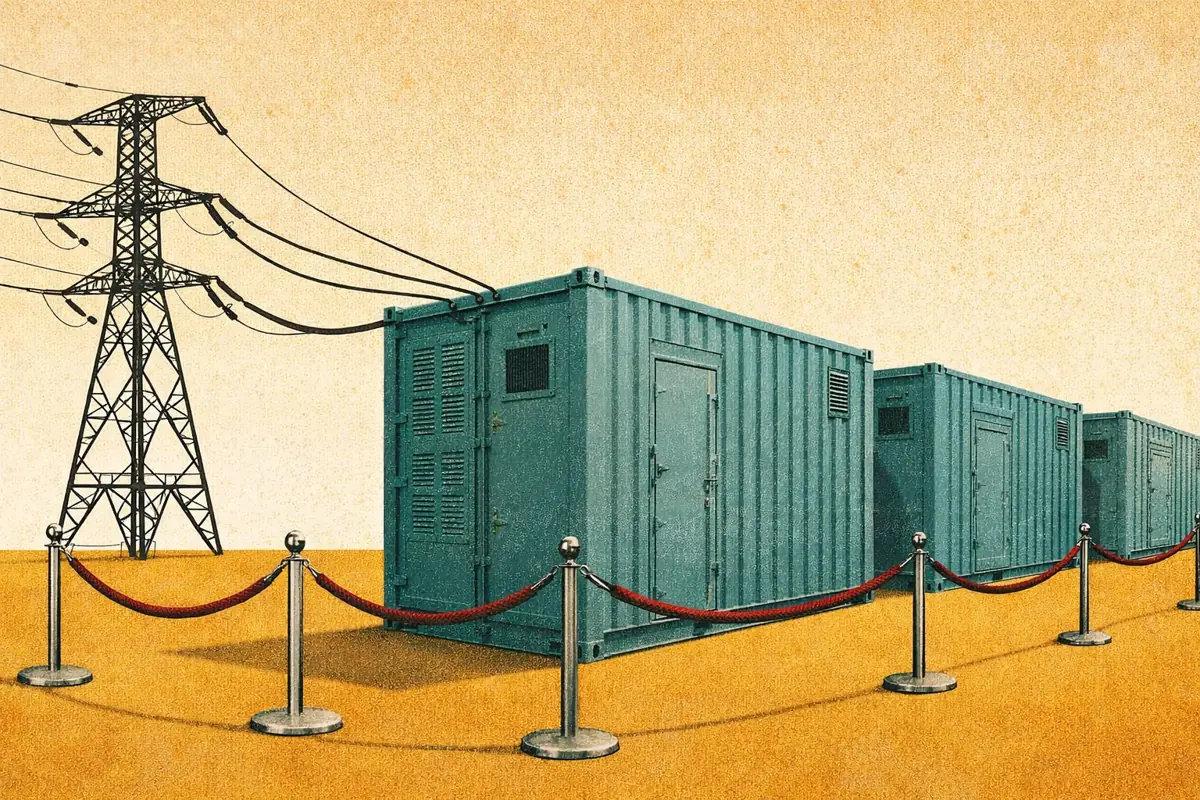

Local flexibility markets: what is the value for BESS?

Executive Summary

- In 2023, UK distribution network operators (DNOs) contracted a record 3.2 GW of capacity into local flexibility services.

- Grid-scale batteries currently participate in only one local flexibility service—Operational Utilization.

- Despite high dispatch prices, flexibility services add only a small revenue uplift for BESS today.

Subscribers to Modo Energy’s Research will also find out:

- How upcoming standardization by Elexon could improve access for grid-scale BESS in local flexibility markets.

- Why electric vehicles and distributed assets dominate these services.

- Whether increasing contracted capacities could make flexibility markets a meaningful revenue stream for grid-scale batteries in the future.

To get full access to Modo Energy’s Research, book a call with a member of the team today.

Introduction

In 2023, distribution network operators (DNOs) contracted a record 3.2 GW of capacity into local flexibility services. Currently, the highly localized, small volumes available in these markets make them better suited for distributed assets such as electric vehicles. However, the size of these markets has been growing by an average of 50% per year over the past four years. With two grid-scale batteries qualifying into the most recent tender round, could these services prove valuable in the future?

Already a subscriber?

Log in