ERCOT: How did power prices evolve in 2024?

Executive Summary:

- Power prices nearly halved in 2024 - Real-Time prices dropped 46% and Day-Ahead prices fell 49% year-over-year due to milder weather, flat demand, and increased solar and storage capacity.

- Top-Bottom One-hour (TB1) spreads averaged $98/MWh - a 61% drop from 2023. However, two major price spikes in May and August provided lucrative but short-lived opportunities.

- Congestion at the zonal and nodal level shaped price dynamics. Energy arbitrage opportunities were consistently the strongest in the West Load Zone.

Subscribers to Modo Energy’s Research will also find out:

- What drove the decline in ERCOT’s power prices and ancillary service prices in 2024,

- How the diminishing returns between the value of top-and-bottom one-hour spreads, two-hour spreads, and four-hour spreads have evolved,

- How ERCOT’s daily energy price patterns have shifted over the years and what’s driving the latest market dynamics

- Where the biggest risk-reward tradeoffs exist for storage operators in ERCOT’s nodal price spreads

From 2023 to 2024, power prices in ERCOT almost halved - with Real-Time prices decreasing by 46%, and Day-Ahead prices decreasing by 49% (on average).

System-wide Real-Time prices, represented by the ERCOT Bus Average Hub, fell from an annual average of $48/MWh in 2023 to $26/MWh in 2024. And Day-Ahead market prices fell from $55/MWh to $28/MWh.

Real-Time prices were closely aligned with trends in the Day-Ahead, trading at a 5% discount across 2024, on average. However, Real-Time prices did diverge under certain conditions and exhibited more volatility - particularly during periods of limited supply or rapid fluctuations in both demand and supply.

Overall, prices in 2024 were significantly less volatile than the previous two years. This naturally reduced Energy arbitrage opportunities for battery operators.

Variation in zonal prices points to inter-zonal congestion patterns

Locational prices reflect the transmission constraints that arise when transporting power across long distances.

The chart below compares the daily average Real-Time Energy prices - by price hub - to the ERCOT Bus Average hub, to call out locational differences.

A look at the daily average Real-Time Energy price shapes suggest that the West and Panhandle regions deviated the most from the system average. This is a result of higher congestion in these areas, driven by relatively low demand and the high penetration of wind and solar generation.

Prices in the West deviated the most during the sunrise (6-7am) and sunset (around 7pm) hours.

West zone prices exceeded the system average during the hours when the sun was down. During these off-peak hours, local industrial demand - largely from the oil and gas industry - often results in parts of West Texas needing to import power to serve demand.

This demand tends to hold a more consistent value throughout the day, rather than following a typical residential demand pattern. As a result, congestion often arises when importing power to serve this demand when the sun is down. At night, local solar generation is offline and unable to contribute, ultimately raising prices in the region.

Conversely, prices in West Texas were lower than the Hub between 9am and 4pm. This is due to increased supply as the sun rises and solar generation begins to produce power.

Real-Time prices in the Panhandle region were consistently lower than in other zones, with high wind generation creating abundant supply. The region also experienced more hours with negative power pricing. This was driven by localized oversupply and insufficient transmission capacity to deliver excess power to higher demand areas.

ERCOT’s daily peak prices now happen after sunset

Average daily price shapes in 2024 generally fell into two distinct patterns. The warmer months of Q2 and Q3 had a single, more dramatic, evening peak. In Q1 and Q4, occasional cold snaps contributed to a dual-peak structure, with prices peaking in the morning before the sun rise and in the evening after the sun set.

Q1: The first quarter showed a dual peak structure, with moderate morning (7am) and evening (6pm) spikes. Cold weather increased heating demand, driving higher prices in early hours before the sun rose. However, compared to previous years, the magnitude of these peaks was lower, reflecting milder winter conditions.

Q2: The growing impact of solar capacity became evident. Midday prices were suppressed due to high solar generation. However, as solar output declined sharply in the evening (8 PM), prices spiked as thermal generation and battery energy storage ramped up to meet demand.

Q3: The sunset-driven volatility remained. Summer demand peaks in the late afternoon, followed by a drop in solar output. Evening prices surged (6–8 PM) as the system relied on thermal resources and batteries to cover net load.

Q4: This quarter returned to a dual-peak price structure. Morning (7 AM) prices rose with heating demand during occasional cold-weather periods in Texas. Meanwhile, evening peaks remained, but were less extreme than in Q2 and Q3, as demand was generally lower.

Overall, 2024 prices were still suppressed compared to 2023. Milder weather patterns resulted in minimal demand growth - and at times lower demand - than in 2023. This was met by the continued rapid growth of solar generation and battery energy storage systems.

You can read more about the evolution of these trends - and their impact on battery energy storage revenues - in our article on key trends driving BESS revenues in 2024.

Higher top-bottom spreads mean higher revenue opportunities

The top-bottom (TBx) spread measures the difference between the ‘x’ number of highest and lowest hourly prices within a day. The TB metric serves as a useful benchmark to estimate the potential energy arbitrage revenue a battery could achieve under ideal trading conditions with perfect foresight.

Battery energy storage systems, which act as both consumers - when charging - and generators - when discharging - earn revenues from arbitraging these spreads.

Thus, higher price spreads = higher revenue opportunities.

In 2024, the top-bottom one-hour spread (TB1) in Real-Time prices averaged $98/MWh, marking a 61% reduction from the previous year.

Two major price spikes, on May 8th and August 20th, pushed TB1 spreads beyond $3,000/MWh. Battery operators who capitalized on this could have earned real-time revenues up to 30 times higher than the 2024 average.

2024 TB spreads were significantly lower compared to the last two years

Real-Time price spreads narrowed in 2024, as unexpected volatility and scarcity pricing events were less frequent. Milder weather patterns, increased solar and storage capacity, flat load growth, and a decline in natural gas prices all contributed to the shifting TB dynamics.

While TB spreads remained subdued for most months of 2024, there were anomalies during high demand or extreme weather periods, which created short-lived but lucrative opportunities for battery storage.

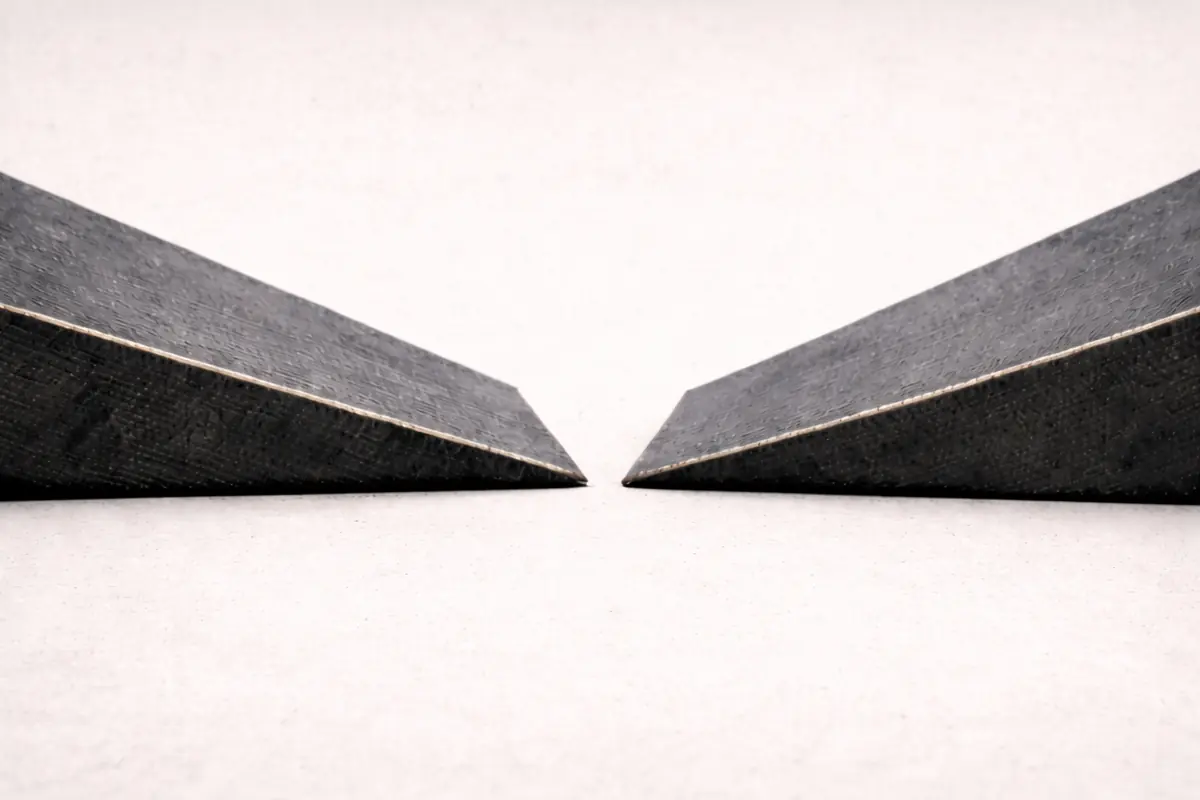

Top-Bottom spreads (TB1, TB2, TB3, and TB4) show clear diminishing returns with each additional arbitrage hour added

TB1 consistently captures the most lucrative opportunities, as it focuses on the highest price volatility within a day.

Each subsequent hour adds less incremental value.

This means that longer-duration batteries would see diminishing incremental returns for every additional hour of spreads captured during a given operating day. For these longer-duration systems, the reduced arbitrage gains likely does not justify the additional investment in capital.

Solar and storage boom, along with flat demand growth led to a shift in peak price hours

In 2022, prices consistently peaked in the afternoon around 4pm, aligning with peak load hours. However, by 2023, the price peaks had shifted to early evening, coinciding with sun set at around 7pm.

This trend continued in 2024, with peak prices now occurring almost exclusively during net peak load hours. This is when solar generation output reduces while demand remains relatively high.

This shift can be attributed to increasing solar capacity and generation in ERCOT.

Additionally, daily average peak prices in 2024 were 2.6 times lower than 2023. This was largely a product of the contribution of additional battery energy storage capacity participating in the Energy markets.

In 2024, Ancillary Service prices hit their lowest levels since batteries first entered the market

Prices fell to just one-third of 2023 levels, dropping from $21.8/MWh in 2023 to $7.03/MWh in 2024 (volume-weighted annual average).

Two key factors drove this decline.

- Low energy market volatility: Ancillary Service prices are inherently tied to the value of the Energy market. If resources can make more money producing Energy, it increases the value of Ancillary Services. With lower Energy prices in 2024, Ancillary Service prices followed suit.

- Rising battery participation: As more battery capacity is offered into the Ancillary Service markets, competition to receive awards increases.

Batteries now consistently provide over 50% of all Ancillary Service responsibility. In Regulation and RRS, this figure is closer to 90%. More batteries are operational and able to offer to provide these services, and so capacity is being offered at lower prices in order to receive awards. This, in turn, suppresses prices.

With Ancillary Service prices declining, battery operators are increasingly shifting their focus toward Energy arbitrage instead.

Price spreads across nodes in ERCOT highlight risk-reward tradeoffs

As of 2024, there are about 17,000 nodes in ERCOT. Around 900 of these are considered 'settlement points', based on the presence of an operational generation or load resource at that location.

Generally, Locational Marginal Prices only vary substantially between settlement points, while individual electrical buses often have similar pricing outcomes to nearby settlement points. This is because there is little to differentiate them electrically from nearby locations, meaning there is little to influence differences in LMPs at that specific electrical bus.

Settlement points with higher annual average spreads tend to experience greater fluctuations in monthly price spreads. So, while certain nodes offer high arbitrage revenue potential, they are also subject to price variability.

For energy storage operators and traders, the diversity in spreads mean high-earning nodes come with a level of unpredictability. The most lucrative nodes tend to generate outstanding returns in select months, rather than consistently performing throughout the year.

The ideal nodes are those that more consistently have high Energy arbitrage spread opportunities, rather than having larger isolated spikes - and therefore more variability in the available spread at that node - month-to-month or day-to-day.

These nodes are likelier to have a persistence in their spread opportunities year-to-year. This is because they have a lower likelihood of new developments like transmission lines or varied system conditions resolving the underlying cause of higher price spreads in the area.

Clusters begin to emerge over the course of the year that highlight these varied market outcomes.

- Moderate spread, moderate variability: The majority of nodes fall in this category, offering stable but lower revenue potential of between $80 - $120/MWh. This is generally in line with the system average.

- High spread, low variability: These nodes provide strong returns with moderate to low volatility. This is ideal for consistency year-to-year and predictably of opportunity.

- High spread, high variability: These are riskier nodes with exceptional earnings potential, but driven by extreme price swings as a result of more isolated transmission congestion incidents.

Energy arbitrage opportunities were consistently the strongest in the West Load Zone

In 2024, the nodes in West Texas had persistently higher annual average spreads and maintained a relatively consistent range in monthly spreads.

This suggests that nodes in West Texas sustained high spreads throughout the year, due to inherent congestion issues and transmission limitations.

Nodes in the North and Houston Load Zones showed less spread variability, but also lower average spreads overall. These nodes are tightly clustered at lower annual spreads, with lower monthly spread ranges. Prices in these regions are much less frequently impacted by local congestion issues. As a result, they often more closely resemble prices across the rest of the system.

Nodes in the South Load Zone are extremely scattered. Localized congestion issues in the Rio Grande Valley mean that some nodes had instances of extremely high prices and spreads. In other months, these nodes had spreads that were among the lowest across the entire system. This contributed to higher variability between the highest and lowest monthly average spreads, and to lower overall average spreads.

Higher average prices result in higher Energy arbitrage spreads

In the South and West Load Zones, nodes vary significantly within each region in terms of their Energy arbitrage opportunities.

These regions both cover large land areas with high amounts of wind and solar generation. In parts of each zone, demand is also minimal. These factors ultimately result in many more congestion issues in South and West Texas than in the North or Houston Load Zones.

Many of the high spread-high price nodes in the West Load Zone are in Far West Texas.

Consistent and growing industrial demand from the Permian Basin’s oil and gas sector creates a need for around-the-clock power in the region, and contributes to the strain on the area’s transmission system. When local solar generation is unable to contribute to meeting this demand, prices in the area often rise relative to the rest of the system.

Additionally, prices in West Texas tend to be among the lowest in the middle of the day when solar generation is at its peak. This further increases the size of the spread for many of these nodes.

Some nodes in South Texas see suppressed prices due to wind and solar over-generation causing curtailment, leading to low daily minimum prices. Wind-heavy nodes tend to experience lower minimum prices, creating a wider spread.

Nodes in North and Houston zone mostly fall in the low spread-low average price spectrum. These regions are less impacted by congestion. Generation is often sited closer to demand, while the transmission network in each region is generally more robust.

How might power prices evolve in the future?

Demand in ERCOT is poised to grow substantially in the coming years. In fact, ERCOT’s recently released Capacity, Demand, and Reserves Report indicates that a conservative estimation of peak demand growth by 2030 would be around 15-20%.

Power in ERCOT is generally inexpensive relative to other wholesale markets in the United States. As a result, industrial customers like data centers continue to be interested in the region. Meanwhile, the presence of enormous amounts of shale in Far West Texas mean that as transmission development continues in the area, demand for power will continue to grow in the area alongside oil and gas industry operations.

Ultimately, this means that volatility is poised to return to ERCOT at some point in the coming years.

There will always be a push-pull dynamic that occurs. The continued deployment of solar generation and battery energy storage means that supply may outpace demand growth in the near future. However, in more extreme weather years like 2022 and 2023 where demand also grows rapidly, volatility - and therefore higher Energy price spreads - will return.

Download the data behind the article

Download