The ERCOT Forecast: How does the supply stack change by 2050?

The ERCOT Forecast: How does the supply stack change by 2050?

Executive Summary

- ERCOT’s total installed capacity could grow by 87% by 2050, with solar reaching 113 GW and battery storage expanding 6.5x to 45 GW.

- Coal generation is projected to be nearly eliminated by 2041, while natural gas capacity rises by 6 GW, driven by flexible open-cycle gas turbines.

- Wholesale power prices could peak around 2040, before declining by 2050 - as demand growth slows and renewables expand.

Subscribers to Modo Energy’s Research will also find out:

- How ERCOT’s evolving supply mix will impact battery storage revenue potential through 2050.

- Why AI-driven data center growth is expected to drive rapid electricity demand increases through the 2030s.

- How battery storage will charge and discharge across a typical day in ERCOT’s future grid.

To get full access to Modo Energy’s Research, book a call with a member of the team today.

Introduction

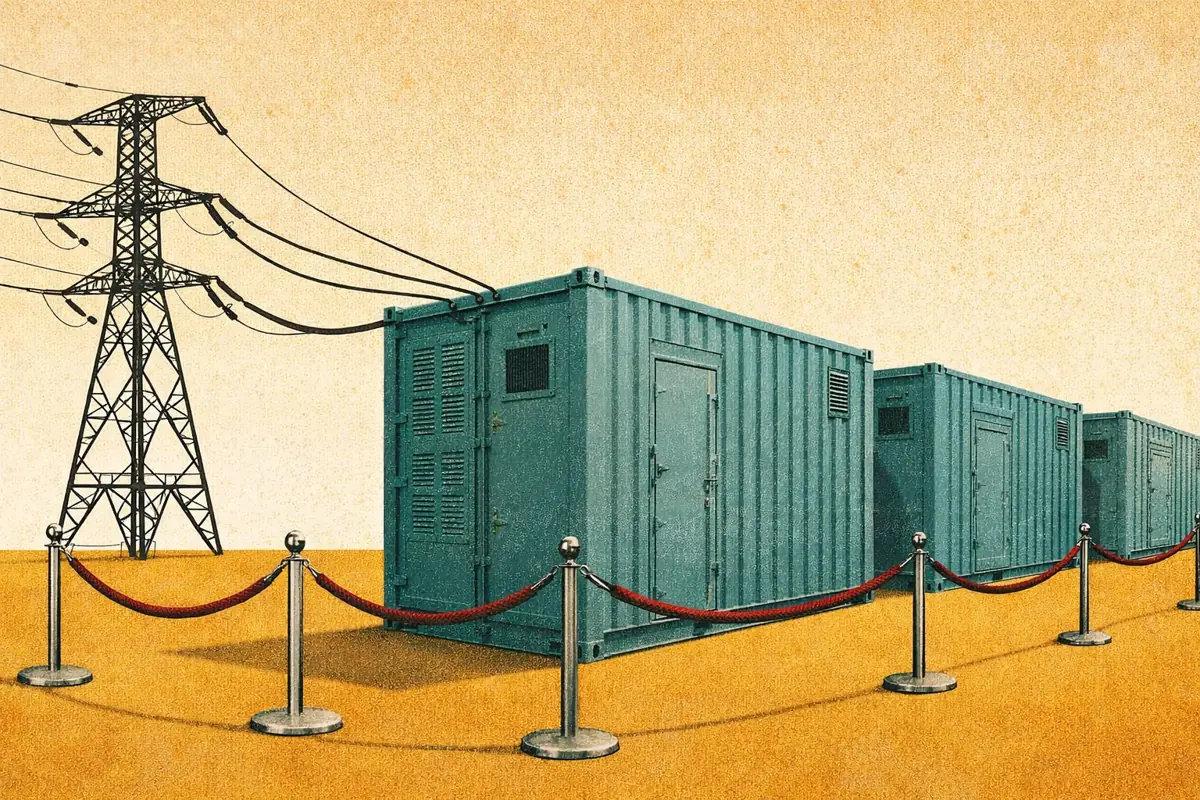

ERCOT’s power grid is evolving - fast. Developers are rapidly building newer technologies, such as solar generation and battery energy storage systems, to meet growing demand. In fact, in the past year alone, installed solar capacity has grown by ~8 GW, or 44%. Meanwhile, the total installed rated power of battery energy storage has increased by ~2.5 GW, or 82%. And there’s no sign of buildout slowing down in the next few years.

Already a subscriber?

Log in