Cycling your battery more than once a day improves project economics in the NEM

Cycling your battery more than once a day improves project economics in the NEM

Battery cycling is central to project economics in the NEM. Most assets have historically targeted one cycle per day because it aligns with warranties, but this leaves value on the table when market conditions support additional cycling. Higher cycling lifts revenues but also accelerates degradation, making the trade-off between early returns and long-term performance a critical factor in determining the value a battery can deliver.

Across 2025, batteries averaged 0.85 cycles per day, with a clear seasonal pattern. Cycling increased through winter as higher demand and lower renewable output provided greater trading opportunities. It then eased through spring and early summer. The annual average shows that most assets remain below their warranty limits.

Batteries are cycling more in 2025 than last year, driven by higher energy price volatility and FCAS saturation, which makes energy arbitrage the more attractive revenue stream. Price signals are strengthening, but most assets still cap cycling at or below one cycle per day due to warranty constraints.

This article breaks down how cycling rates, degradation, repowering costs, and market conditions interact to determine where battery value is maximised in the NEM.

Executive summary:

- Batteries cycled 0.85 times per day in 2025, below the standard one-cycle-per-day warranty allowance.

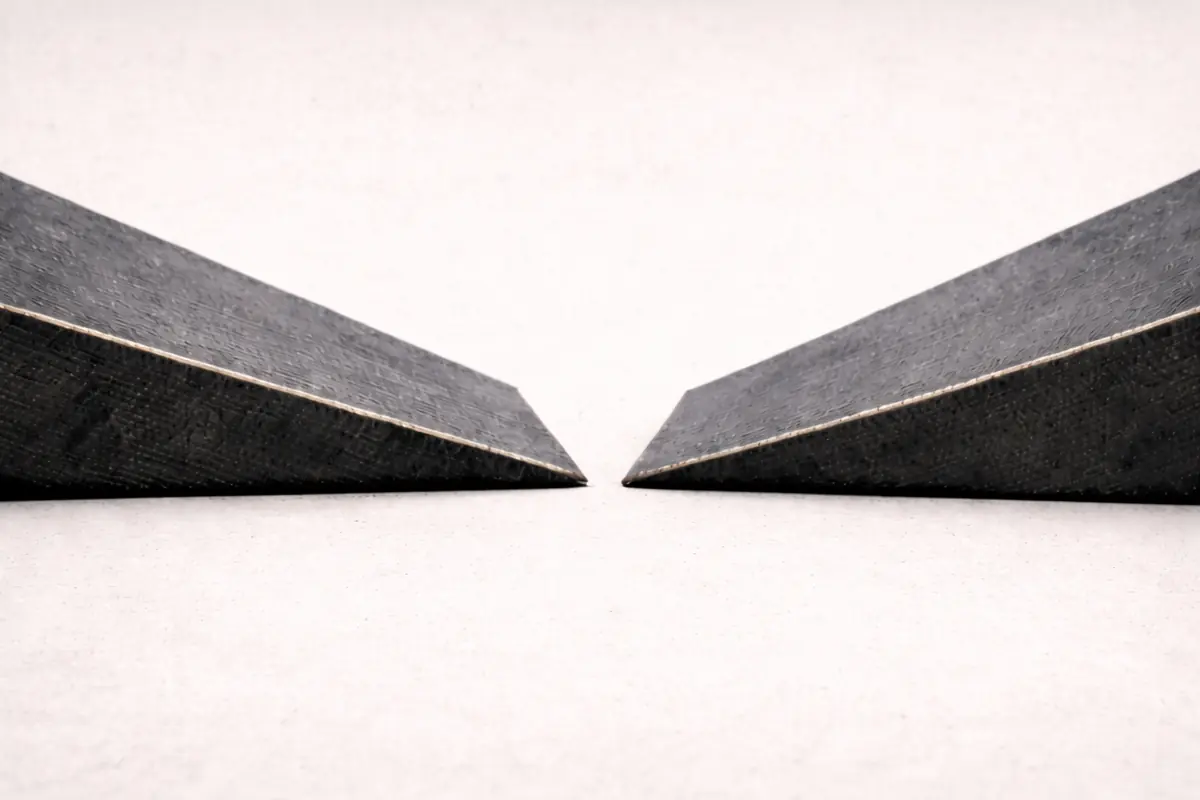

- The optimal cycling range is 1.3–1.5 cycles per day when coupled with repowering. Cycling beyond this threshold accelerates degradation without delivering meaningful additional value.

- Victoria shows the highest long-term cycling potential, supported by its distinct morning and evening peaks.

- Cycling variability narrows over time as batteries and pumped hydro reduce volatility, leaving cycling driven mainly by fundamental spreads.

Cycling more than once per day leads to the highest project returns

Despite batteries currently cycling under once per day on average, our modelling suggest when coupled with a strategy for repowering. Most assets focus on trading the spread between the middle of the day and the evening peak, leaving money on the table from the morning peak. Increasing cycle limits allows assets to capture this additional revenue, but at the cost of faster degradation.

Already a subscriber?

Log in