Dynamic Regulation: Does Balancing Mechanism registration impact strategy?

Dynamic Regulation: Does Balancing Mechanism registration impact strategy?

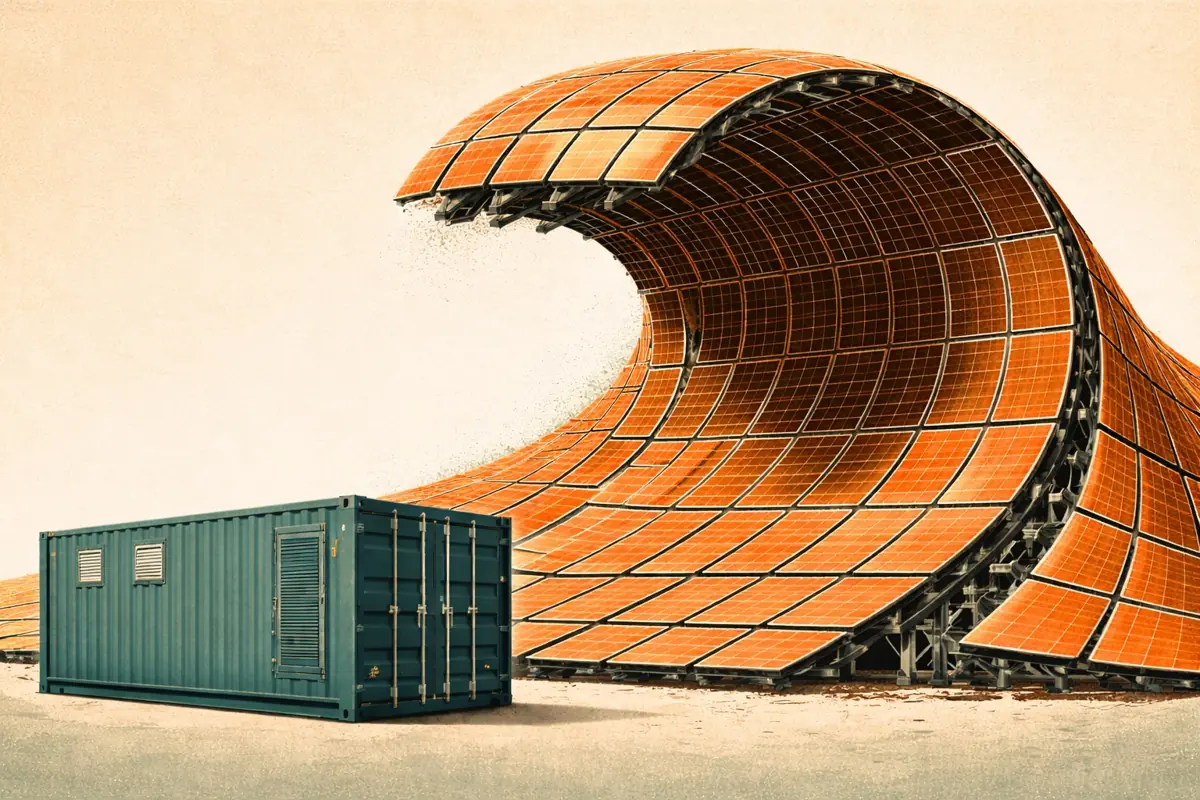

Battery energy storage revenues fell to their lowest-ever level in November 2023. Systems averaged £2.9k/MW, mainly due to falling dynamic frequency response revenues following the launch of the Enduring Auction Capability. However, not all batteries have been affected in the same way.

In October, the top ten performing batteries were all Balancing Mechanism-registered (BMU), two-hour systems. In November, four of the top ten best-performing assets were Non-Balancing Mechanism Units (Non-BMU), all under 1.5 hours in duration, generating revenue from Dynamic Regulation. So why has this shift occurred?

- The Enduring Auction Capability launch in November has led to prices for all frequency response services falling, aside from Dynamic Regulation Low. Revenues for Balancing Mechanism-registered systems fell 40% as a result.

- Dynamic Regulation High has been affected the most, with prices turning negative. Dynamic Regulation revenues for two-hour systems using this service have now fallen to zero.

- Non-Balancing Mechanism-registered batteries, by contrast, increased revenues in November by following a Dynamic Regulation Low heavy strategy. Higher-priced BM-registered systems have set prices for this service.

- This difference in price and strategy is because of ABSVD. This means BM-registered systems do not pay (or get paid) for the energy they deliver through frequency response.

- More and more non-BM systems are now switching to a Dynamic Regulation Low strategy, which is expected to cause prices to fall from November’s highs.

The Enduring Auction Capability has affected strategies in different ways

Frequency response markets made up 50% of revenue for battery storage systems in October. So, when total auction costs fell by over a third in November, almost all systems saw revenues drop. However, batteries follow different strategies, and the deciding factor in which strategy to follow for BM-registered batteries is their duration.

70% of one-hour BM-registered batteries generate revenue from Dynamic Containment High and Low alongside trading energy in the wholesale market. This strategy relies on high Dynamic Containment prices and high day-ahead price spreads.

Already a subscriber?

Log in