Comparing battery energy storage arbitrage strategies in ERCOT

Comparing battery energy storage arbitrage strategies in ERCOT

Executive Summary

- Energy arbitrage now makes up 26% of ERCOT battery revenues, with this share expected to grow as Ancillary Service prices continue declining.

- A perfect Day-Ahead/Real-Time arbitrage strategy would have outperformed the ME BESS ERCOT Index in H1 2024 by 31%.

- A hybrid DA/RT approach, balancing price certainty and flexibility, could have yielded similar per-cycle revenues to the H1 2024 BESS Index - while reducing overall number of cycles.

Subscribers to Modo Energy’s Research will also find out:

- How ERCOT battery operators are adapting trading strategies as Energy arbitrage overtakes Ancillary Services in revenue share.

- Why per-cycle revenues differ significantly between Day-Ahead and Real-Time arbitrage approaches.

- What role optimized bid strategies play in minimizing cycling while maximizing wholesale trading returns.

To get full access to Modo Energy’s Research, book a call with a member of the team today.

Introduction

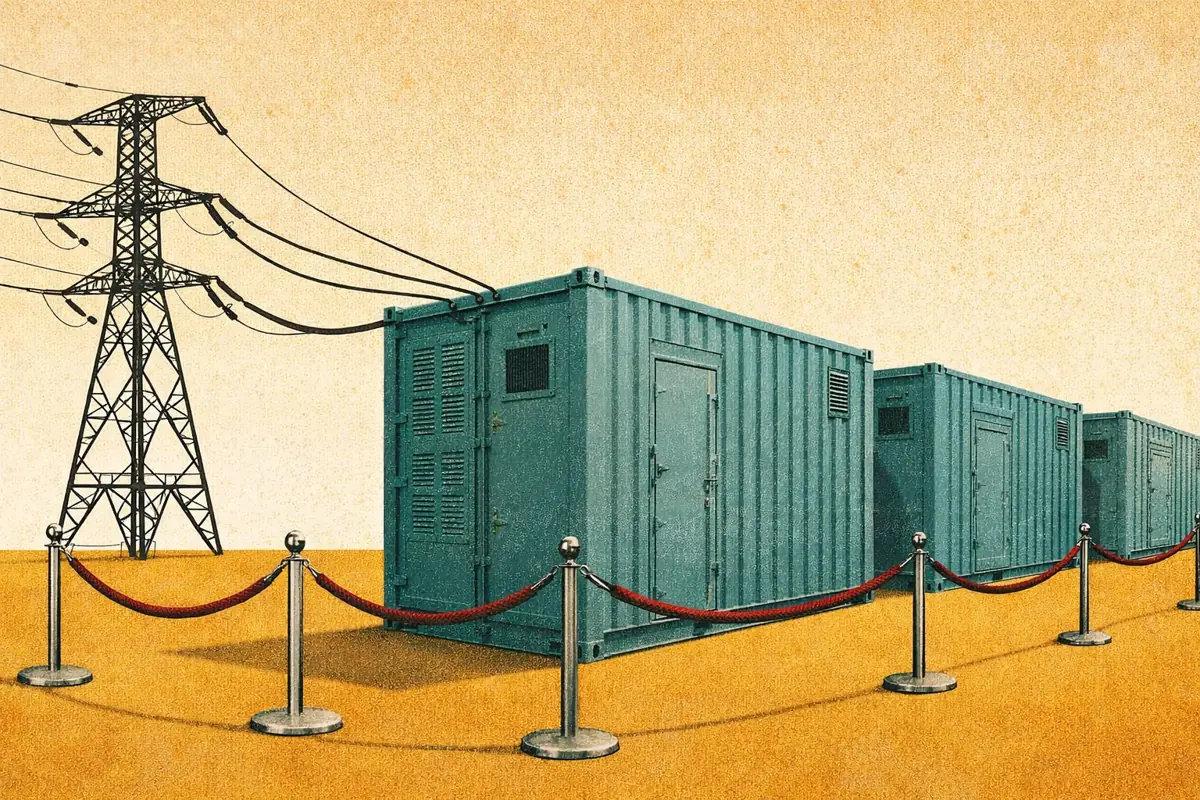

The revenue stack for battery energy storage systems in ERCOT is changing. Ancillary Service clearing prices are declining, relative to Energy prices. Additionally, more batteries are becoming commercially operational every month - meaning more competition in those markets.

As a result of these changes, more battery energy storage capacity is available to perform Energy arbitrage. And the proportion of revenues from Energy has increased to in 2024 - as highlighted in .

Already a subscriber?

Log in