Australia: Battery energy storage & the CIS and LTESA schemes

Australia: Battery energy storage & the CIS and LTESA schemes

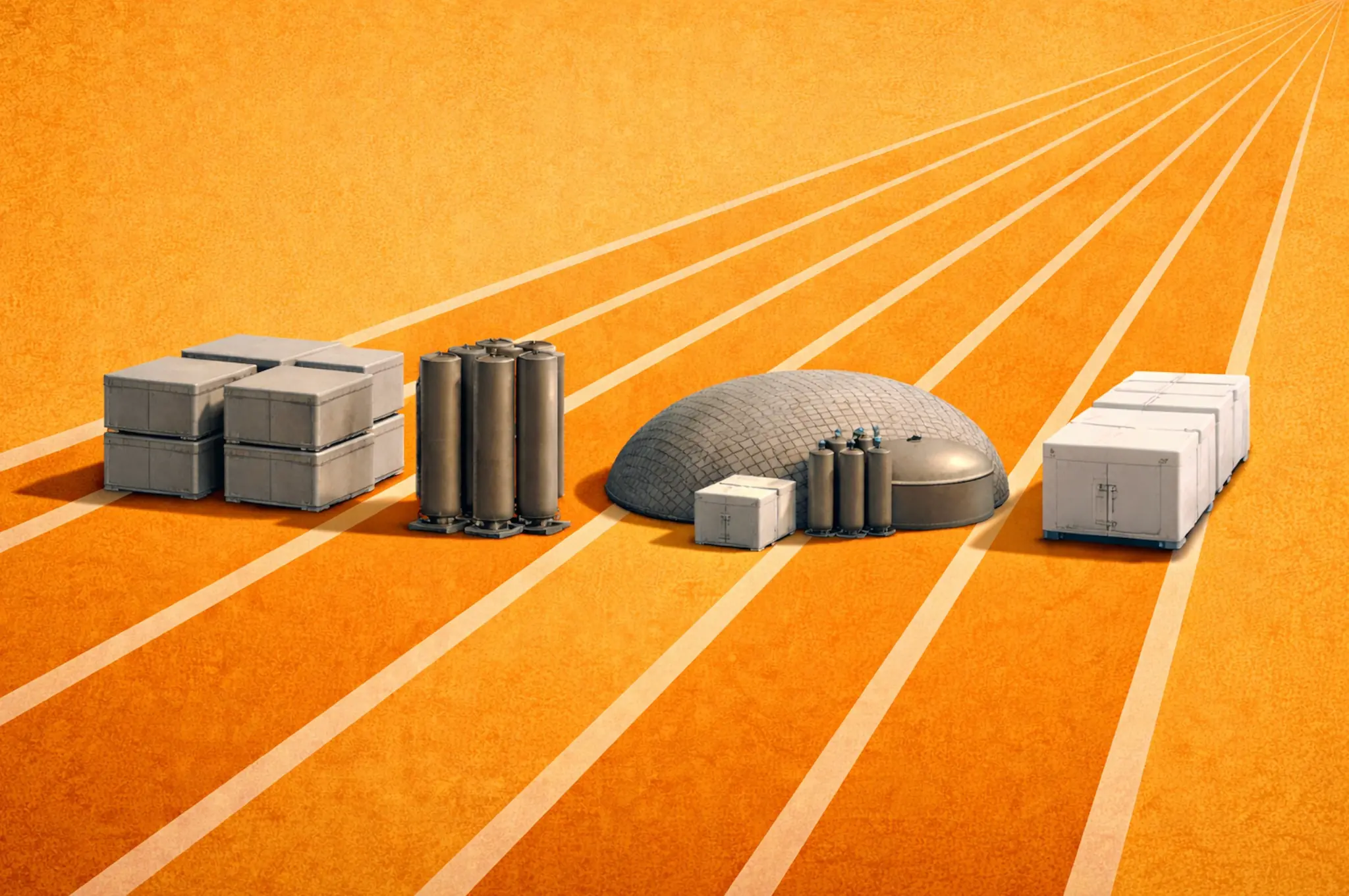

16 GW of battery energy storage capacity is in the NEM pipeline to the end of 2027, a quarter of which has a long-term government-backed revenue guarantee. This is through either the Capacity Investment Scheme (CIS) or a Long-term Energy Supply Agreement (LTESA). These schemes were established to support the construction of new generation and flexible capacity.

In this article, we look at both these schemes and the battery projects that have won contracts.

Executive Summary

- The Capacity Investment Scheme (CIS) and Long-Term Energy Service Agreements (LTESA) are government-backed revenue floor contracts aimed at accelerating clean energy and storage projects in Australia.

- CIS is a federal scheme supporting both the NEM and WEM, while LTESAs are a New South Wales-specific policy under the state’s Electricity Infrastructure Roadmap.

- Tenders from both schemes have awarded 3.8 GW of battery contracts to date — over half of which are long-duration or co-located with renewables.

- Minimum revenue guarantees from these schemes are helping projects reach financial close — especially four-hour and eight-hour batteries that may otherwise struggle commercially.

What are the CIS and LTESA schemes?

The CIS and LTESA schemes were both introduced with a similar objective: to secure new, low carbon generation and flexible capacity. The key difference between the two is that the CIS is run by the federal government, while LTESAs are from the New South Wales state government.

: a federal support policy for clean generation and dispatchable capacity. This is with the aim of helping Australia meet a goal of 82% renewable electricity by 2030. Contracts last 10-15 years and offer a long-term revenue cap and floor, with both values bid for in competitive tenders. The scheme supports new capacity in both the NEM and WEM.

Already a subscriber?

Log in