Battery Energy Storage Buildout Report 2023: what’s coming online?

Battery Energy Storage Buildout Report 2023: what’s coming online?

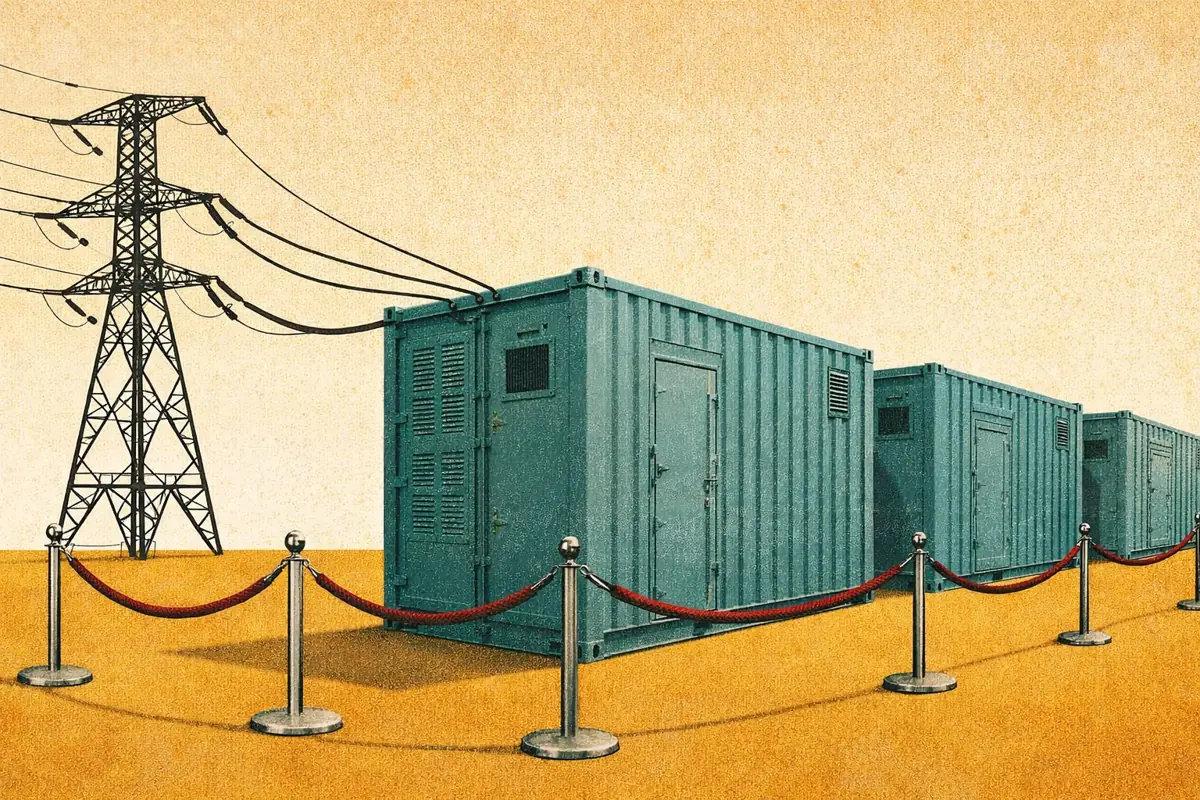

Batteries are coming online faster than ever before - and they’re getting bigger! So, how much new battery energy storage capacity can we expect to see by the end of 2026? And where will it come from?

The headlines

- We will exceed 10 GW of battery energy storage capacity by 2026 - and could hit 12 GW!

- 3.7 GW of this capacity is due to come from just 12 sites - with batteries as big as 450 MW due to come online.

- There’s also a big shift in system duration - with 6 GW of this new-build capacity expected to come from two-hour systems.

Great Britain’s battery energy storage pipeline

So, what does this level of growth actually look like? Figure 1 (below) shows historic and expected battery energy storage capacity, by quarter - across the decade 2017-2026.

You can download the data behind these new asset capacity numbers here.

The expected buildout level over the next four years is much faster than previously anticipated - with 2023 in particular set to be a bumper year for new batteries coming online.

- Current capacity sits at around 2.4 GW.

- Almost 3 GW more is expected to be added throughout this year.

- This would take the total capacity by the end of 2023 to over 5 GW.

The data shows that we are due to see:

- an increase in the number of new assets becoming operational,

- a faster deployment rate, and

- a trend towards bigger assets.

Taken together, these factors are driving this big ramp-up in capacity.

The dawn of the 'mega-battery'

Some of the new battery energy storage assets coming online in the next four years will be huge - 'mega-batteries' to rival those seen in Australia and the USA.

Figure 2 (below) shows the number of existing and expected battery energy storage assets in Great Britain - grouped by capacity (MW).

- Most battery energy storage sites due to come online by 2026 will have a capacity of <90 MW.

- There are currently three batteries in Great Britain with a capacity of around 100 MW (Pillswood, Minety and Capenhurst).

- In the remaining months of 2023, eight new sits of around 100 MW (i.e. with a nameplate capacity of 99 - 100 MW) will enter the markets - but we are unlikely to see any sites with a capacity above 100 MW become operational in 2023.

- By 2026, the fleet will have at least 20 batteries with a capacity of 100 MW or more.

As shown in Figure 3 (below), 2024 will see a step-change in the size of battery energy storage assets.

- There are two 400 MW / 800 MWh assets due online in 2024 - Kincardine and Hunterston. These assets form part of Amp Energy’s ‘Scottish Green Battery Complex’ project.

- In 2025, Great Britain’s biggest battery is due to come online - the 450 MW / 900 MWh Gateway Energy Centre project. This will be owned by InterGen, which was purchased by the CREDITAS Group earlier this year.

Battery energy storage duration - it’s a marathon

Figure 4 (below) shows a big shift in system duration, with owners and developers increasingly favouring two-hour systems.

All of those larger battery energy storage assets (150 MW or more) we looked at above are expected to have durations of at least two hours.

Who will own what?

There are many new battery energy storage owners joining the fleet in the next four years - it’s difficult to gauge the exact number, but we expect at least 20 new players to enter the fold. This includes a few international names.

There are also plenty of established owners looking to significantly increase the size of their respective portfolios in the next few years.

Head here to see a full list of the new sites expected to join the fleet by 2026 - and their owners.

Location, location, location

Figure 5 (below) shows where these new battery energy storage assets will be built. The size of a given circle represents its capacity.

These new sites are being built across the whole of Great Britain.

- Most new build capacity will be in England. England will go from having 2 GW of capacity now, to almost 8 GW in 2026.

- Thanks to those big batteries, capacity in Scotland is due to increase twentyfold - from 0.2 GW to 4 GW by 2026.

- Wales will see an increase from less than 30 MW to 0.4 GW.

A quick word on co-located battery energy storage

We can also expect many more batteries to be co-located with other generation. (To learn more about co-located battery energy storage, check out our article.)

For example, many of the new batteries from Enso Energy will be co-located with solar farms. Elsewhere, the 300 MW Eggborough Battery A will be co-located with a new 1.7 GW CCGT - on the same site as the old coal power station.

This approach will be common for many new assets as they exploit available connection capacity - but how they do this will differ from site to site. This is something to look out for as these sites are developed.

Download the data

The data used in this article can be downloaded as an Excel file here.

Where do our numbers come from?

Each battery energy storage asset identified has been individually researched and analysed using an aggregation of multiple sources. This provides us with as much visibility of future assets as possible.

So, what sources did we use?

- We have assessed Capacity Market agreements for delivery years 2022-2026. This includes the aggregation of multiple contracts awarded to individual sites, and the acquisition of sites by new owners.

- Other sources used include the Renewable Energy Planning Database (REPD), connection registers, network operator registers, National Grid ESO’s Stability Pathfinder, the Regulatory News Service (RNS), company annual reports, as well as news articles and press releases.

- Where possible, we have spoken to owners and developers of identified assets - to gain a greater understanding of expected commissioning dates.

- In instances where no information has been available, approximations have been made. This includes our best estimations of duration and energy capacity, which we have determined using details from the Capacity Market register. In some cases, we have used the delivery year of Capacity Market contracts to determine the latest possible commissioning date.

However, it should be noted that these dates and details are not definite. Assets can come online later (or sooner) than expected - with different capacities and durations. Some assets may also be ‘energised’ but not entered into any markets, therefore limiting visibility.

We know this information is not always perfect - so please get in touch if you think something needs correcting.