LMP - Part One: what is nodal pricing?

The Energy Systems Catapult (ESC) has recently published a report recommending that the GB power markets move to nodal pricing. Policy Exchange is similarly advocating locational pricing, and National Grid Electricity System Operator (ESO) have also shared similar opinions on it in the last week or so.

In this article, we’ll take a look at:

- What nodal pricing is.

- How it can incentivise intelligent operation and system design.

- The drawbacks of nodal pricing.

In the video below, you can watch our discussion about nodal pricing:

What is nodal pricing?

Nodal pricing, also known as Locational Marginal Pricing (or LMP), is a way of determining the price of electricity that varies depending on location.

Currently, supply and demand around the country determines a single price for electricity across the whole system. Conversely, under the LMP framework, the network is divided into smaller regions, called nodes, with different electricity prices at each node. Examples of possible nodes are shown in Figure 1 (below).

Crucially, LMP means that the price of electricity does not only reflect the commodity costs of energy (e.g. fuel and carbon costs). It also the cost of transporting the energy from where it is generated to where it is consumed, including the cost of network congestion.

LMP would be a big change to the way electricity is priced in GB. However, it has been rolled out in other places around the world. In North America, for example, several independent system operators (or ISOs) use LMP, including in Texas, California and New York.

What about use of system charges and system actions?

In single energy price markets, there are mechanisms that can help signal pricing: network costs have various locational elements. In GB, distribution and transmission costs vary by the 14 Grid Supply Point (GSP) groups. For example, the Transmission Network Use of System (TNUoS) rate in Northern Scotland is less than half that in London (comparing the half-hourly demand tariff for 2022/2023).

In a nodal pricing market, locational value is instead signalled in short-term wholesale electricity prices (spot prices). Short 5-minute settlement windows are suggested, with fairly granular ‘nodes’ at which prices differ. These could be the 14 GSP groups or even the 352 GSPs illustrated in Figure 1 (above). Variations between nodes would dictate the local energy economics - and therefore prices.

The markets would do more of the balancing between supply and demand, and constraints would be managed through market incentives. The system would be more efficient, so total system costs would be lower.

While GB has decarbonised to ~40% renewable energy, system balancing costs have skyrocketed. The ESC report estimates that £0.5bn of the £1.3bn spent on balancing the system in 2020 was due to managing constraints. In Figure 2 (below), we can see that these costs are set to accelerate as more intermittent generation comes onto the system. Nodal pricing is seen as a way to reduce these costs without significant investment in network infrastructure.

The implications of nodal pricing

Nodal pricing incentivises generators and flexibility providers to both locate and operate assets in the most efficient way, taking account of physical constraints on the network.

How nodal pricing incentivises ‘intelligent’ dispatch

Consider a node on the Scottish network which has a significant transmission constraint, and behind which a wind farm is producing at full capacity across the evening peak. As this is a rural area, there is little demand. At the same time in Southern England, demand is high, but the wind isn’t blowing and the sun isn’t shining. Figure 3 (below) shows the same day in these two nodes.

Locational energy pricing would lead to low prices at the Scottish node and high prices in the English node through the evening peak (Figure 3, above) - reflective of the supply and demand economics at each. In this scenario, a nearby thermal generator in Scotland would be incentivised to turn down, whilst in SE England a similar generator would be incentivised to turn up. With a single power price across the country, this kind of locational variation in supply and demand is not accounted for, and neither is the transmission constraint at the Scottish node.

With nodal pricing, these distortions would not exist. Generators and flexible assets would be incentivised to dispatch in response to local conditions rather than in spite of them, which would help to efficiently balance the system.

How nodal pricing incentivises investment decisions

By providing granular locational price signals, developers are incentivised to build assets in the places where they will earn the largest returns (ie. where the market dictates system needs are greatest). Flexible assets such as batteries will be placed precisely where their flexibility would help incorporate more renewable generators.

Nodal pricing will not solve everything, though. Local planning arrangements would also need to be updated for optimal locational investment decisions.

Drawbacks of LMP

Nodal pricing would be a huge change. It would be complex, with potentially 352 new nodes to cope with (if each 352 GSP becomes a designated node). Operational systems across the industry would need significant upgrades, and this would require time and money. Some would say our energy system is already complicated enough!

If nodal prices are passed onto domestic consumers, it could create significant differences in energy prices across the country, which could be considered unfair.

And what would happen to the existing renewable sites which are on constrained parts of the network? Lower locational prices mean they may not make the required returns on investment. The cost of being ‘bid down’ due to location would transfer from the network operator to the generator - carrying significant risk on returns. This could put off potential investors.

It may also act as a barrier to renewable developments in large parts of the country. Taking an average across the four scenarios in NG ESO’s Future Energy Scenarios (FES) 2021, as shown in Figure 4 (above), GB requires an additional 11GW (or 190% increase) of onshore wind and 15GW (or 210% increase) of solar capacity by 2030. In order to meet these targets, there should be as few barriers to enabling this capacity to be built as possible.

Final thoughts

National Grid ESO, the ESC and Policy Exchange have all recently come out in favour of reforming GB’s energy markets to include nodal pricing, mirroring the market design in other geographies. It would be a huge change in the way our energy is priced, and could mean massive efficiencies are made in running a highly renewable system, lowering total system costs.

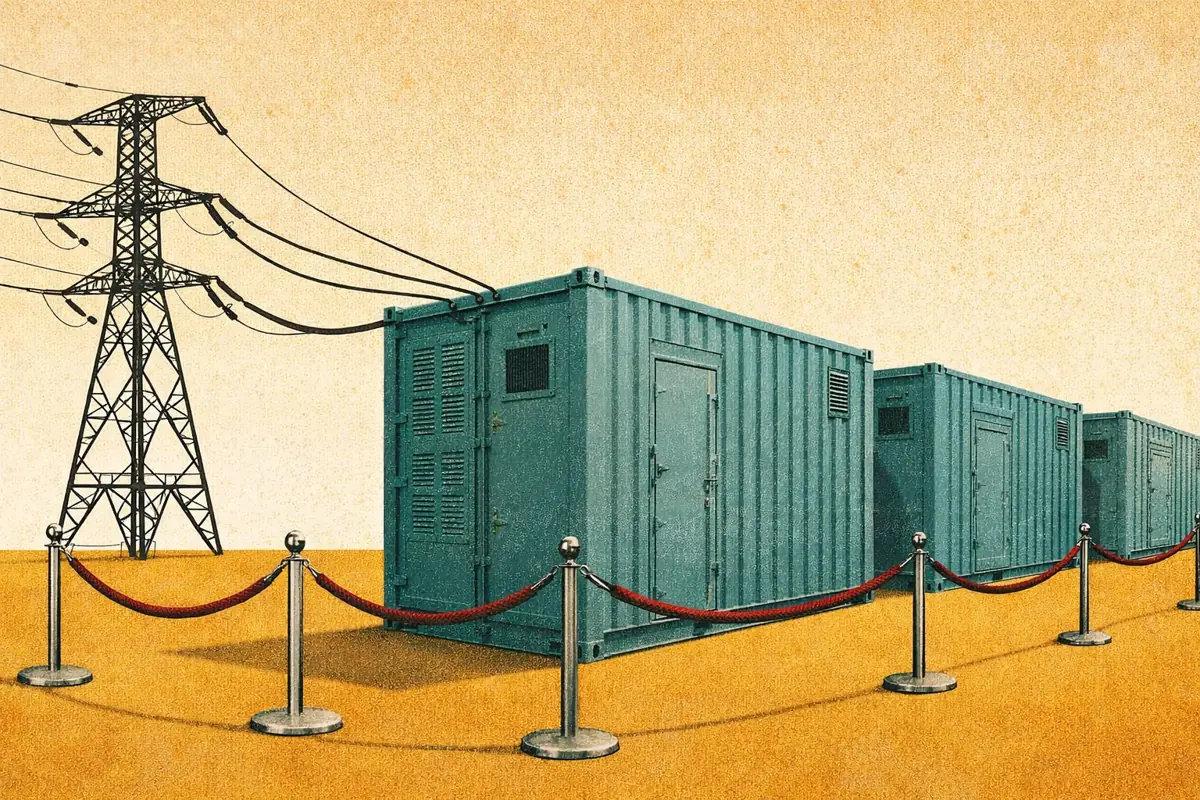

In Part Two, we’ll dive into more detail about LMP and take a look at its implications in the world of battery energy storage.