Last updated: 26 September 2025

GB Methodology

Modo Energy provides benchmark data for battery energy storage systems across global energy markets, applying a standardised mathematical methodology to ensure consistency and transparency across all produced Indices.

Modo Energy publishes the following documents in accordance with the UK Benchmarks Regulation:

1. Introduction

The Modo Energy Great Britain Methodology Framework outlines the calculation and construction of Modo Energy’s battery energy storage Indices in Great Britain. This document provides detailed insights into:

- the inclusion criteria for assets;

- the components that make up published revenues; and

- the methodologies employed;

to ensure accurate and reliable benchmarking for Great Britain’s battery energy storage sector.

1.1 Representation

Modo Energy’s family of indices (the ME BESS GB Indices) represent the revenue performance of grid-scale lithium-ion battery energy storage systems in Great Britain. The indices are constructed to reflect revenues that a representative portfolio of assets could earn from participation in relevant GB electricity markets, based on publicly available data.

To capture differences in technical characteristics, the indices include subsets of assets grouped by system duration. This allows revenues to be compared across different types of utility-scale battery systems.

2. Index Construction

2.1 ME BESS GB Indices

Modo Energy currently produces a family of three indices:

- ME BESS GB: Includes all qualifying assets in Great Britain.

- ME BESS GB (1H): Includes all qualifying assets with a system duration of less than 1.5 hours.

- ME BESS GB (2H): Includes all qualifying assets with a system duration of more than 1.5 hours and less than

2.5 hours.

- The ME BESS GB Index (2H) is calculated from 1 January 2023 onwards, as there were not enough qualifying assets with the required system duration before this date.

All indices in the ME BESS GB family are constructed using the same published methodology, with differences only in the inclusion criteria (asset duration).

2.2 Inclusion Criteria

To be included in the Indices, battery energy storage assets must meet specific criteria:

- Size: Assets must be 6 MW or larger.

- Metering: Assets must not share a meter with co-located assets.

- Registration: Only Balancing Mechanism Unit (BMU) assets are included, as non-BMUs lack operational visibility outside of frequency response markets.

- Availability: Assets must be available as defined in section 2.2.1 (below).

2.2.1 Asset availability

Asset availability is assessed based on market activity recorded for each settlement day. An asset is considered active and included in the daily Index calculation if it has recorded market activities, defined as either:

- submission of Final Physical Notifications (FPNs); or

- holding of ancillary service contracts.

Assets with no recorded market activity on a given settlement day are considered inactive and excluded from the Index calculation for that day. This exclusion applies to all revenue streams except the Capacity Market (see section 4.2.5), where revenues and capacity from all assets with active Capacity Market contracts are always included.

2.3 Index calculation methodology

The index calculation follows a clearly defined, rule-based methodology with no discretionary adjustments, ensuring transparency, consistency, and reliability.

The Index value is calculated daily by dividing the sum of revenues of all active assets (see section 2.2.1) against the sum of their total rated power or energy capacity (see section 2.3.1 for divisor details). This provides an Index value representing a normalised measure of average revenue per unit of capacity for battery energy storage systems in Great Britain.

2.3.1 Divisor

The divisor is a fundamental component of Modo Energy’s BESS GB Indices, acting as a normalisation factor to ensure assets of all sizes can be benchmarked against the produced Indices. It is calculated daily by summing the total rated power or energy capacity of all active assets (see section 2.2.1).

The divisor is recalculated daily to reflect changes in asset availability, ensuring the Index continues to represent assets actively contributing to revenue generation.

2.4 Index value representation

All Index values are reported in terms of net revenues per settlement period. Revenue and Index values can be represented using the following units:

- GBP/MW/hour (hourly): Calculated by dividing the total index value for the assessed period by the total number of hours in the period (days × 24).

- GBP/MW: Calculated by summing the total index value for the assessed period.

- GBP/MW/year (annualised): Calculated by dividing the total index value for the assessed period by the number of days in the period and multiplying by 365 to project an annualised value.

3. Revenue Components

3.1 Revenue Components of Indices

This section details the key revenue streams incorporated into the ME BESS GB Indices, reflecting the primary revenue opportunities available to battery energy storage systems in Great Britain's wholesale markets.

The revenue components included in Modo Energy’s GB BESS Indices are:

- Dynamic frequency response services: These are real-time services designed to maintain system frequency. These services include Dynamic Containment, Dynamic Regulation, and Dynamic Moderation.

- Wholesale market trades: Wholesale markets are platforms where energy is traded between generators, suppliers, and other market participants.

- Imbalance payments: Imbalance payments are financial adjustments made to energy providers for any deviations between scheduled electricity supply/usage and their actual delivery.

- Balancing Mechanism Actions: The Balancing Mechanism is a system operated by NESO to ensure the supply and demand of electricity are balanced in real time, by dispatching or curtailing power.

- Balancing Reserve/Quick Reserve services: The Balancing Reserve and Quick Reserve services procure guaranteed reserve capacity a day ahead of potential delivery - ensuring that capacity is available (to NESO’s Control Room) to be dispatched in the Balancing Mechanism.

- Capacity Market contracts: The Capacity Market is designed to ensure sufficient reliable capacity is available for long-term energy security. Revenues from Capacity Market contracts reflect the monthly payments from awarded Capacity Agreements.

3.1.1 Historic revenue components

For historical reference, revenues from retired services such as Dynamic Firm Frequency Response (FFR) and Enhanced Frequency Response (EFR) are included.

3.2 Excluded revenues

Revenues from certain services or arrangements are excluded from Modo Energy’s Indices calculations. These exclusions include:

- The provision of voltage, reactive power, or other stability services under Pathfinder or other arrangements.

- Revenues from Mandatory Frequency Response.

- Tolling and floor arrangements.

- Distribution Use of System (DUoS) charges.

- Local flexibility markets.

- Bilateral contracts (e.g. Power Purchase Agreements).

4. Data inputs and use of discretion

4.1 Data visibility and quality

Modo Energy only includes assets with sufficient market data visibility in its benchmark calculations to ensure accuracy and reliability. This means that only Balancing Mechanism Units (BMUs) are included, as they provide comprehensive operational data through regulatory reporting requirements. Non-BMUs lack this level of operational visibility outside of frequency response markets and are therefore excluded. Further details on the distinction between BMU and non-BMU data can be found in Modo Energy’s guidance.

4.2 Data inputs and sources

The ME BESS GB Index is determined using publicly available market data, ensuring transparency and consistency in benchmark calculations. Data sources include:

- Market Data: Auction results for dynamic frequency response services (NESO), wholesale market prices (N2EX, EPEX), and Balancing Mechanism actions (Elexon).

- Operational Data: Physical positions and real-time market activity from BMUs, sourced from Elexon.

- Long-Term Agreements: Awarded Capacity Market agreements, provided by EMRS.

Data on battery energy storage system characteristics, such as rated power and energy capacity, is primarily derived from market sources but may also involve discretionary assessments, as outlined in section 4.3.

Indices are updated every half-hour settlement period to reflect the most recent market data. When more accurate data becomes available after the initial publication, the Index is retrospectively adjusted to incorporate these updates, maintaining accuracy and completeness.

4.2.1 Data integrity and validation

To maintain benchmark accuracy, Modo Energy employs automated data collection and validation processes, ensuring the timeliness and reliability of input data. Key validation measures include:

- Automated data collection: Reduces manual errors and ensures consistent updates.

- Source validation: Data is sourced from reputable, verifiable platforms such as National Grid ESO, EPEX, and N2EX.

- Validation checks: Cross-verification against expected values, identification of missing data periods, and outlier detection.

- Ongoing monitoring: Continuous assessment of data quality, with alerts triggered for inconsistencies requiring further investigation.

Once data is validated, the calculation of the benchmark is fully automated, eliminating potential inconsistencies.

4.2.2 Determination of battery energy storage system characteristics

The rated power (MW) and energy capacity (MWh) of assets are determined using publicly available sources such as:

- London Stock Exchange Regulatory News Service (RNS) announcements;

- EMRS Capacity Market Contracts;

- and analysing awarded ancillary contracts.

Rated power assessments focus on an asset’s nameplate capacity rather than its grid connection. Where sufficient public data is unavailable, additional validation may be sought from legal persons associated with the asset, subject to the discretion of the Modo Energy research team (see section 4.3).

If an asset's BMU status changes—whether it becomes a BMU or ceases to be one—it will be included or excluded from the index accordingly from the date of the change. In cases where an asset undergoes augmentation, such as changes to rated power or energy capacity, the updated values will be used in the index calculations from the date of the augmentation.

4.3 Use of discretion

Modo Energy applies discretion strictly within predefined parameters to ensure consistency and transparency. Discretion is exercised only in the following circumstances:

- Asset sizing (MW or MWh): If publicly available data is insufficient, information from credible third-party sources may be considered for validation.

- Selection of data sources and active markets: Sources are selected based on their reliability, relevance to BESS operations, and whether the underlying market is active, with sufficient depth, transparency, and regularity of transactions to provide reliable input data.

- Asset inclusion and identification (Market IDs): Market identifiers (IDs) published by providers such as EMRS, ESO, and Elexon must be matched to the utility-scale BESS included in the indices. Where datasets provide conflicting or ambiguous information, discretion may be applied to verify the correct mapping, including cross-checking across multiple public sources and, where necessary, confirming details with asset owners or operators.

All discretionary decisions are made in accordance with the benchmark methodology and subject to internal governance oversight to ensure impartiality and compliance with regulatory standards.

4.4 Prioritisation of data inputs

The ME BESS GB Index relies on a structured hierarchy of data inputs to ensure accurate daily index calculations, with real-time data taking precedence over post-settlement data. The prioritisation is as follows:

- Real-time market data: Given the highest priority, it is used to assess daily asset availability and performance.

- Post-settlement data: Enhances accuracy by incorporating data published after the initial market period, such as settlement metered data from Elexon, which becomes available five working days after delivery.

This approach ensures the index remains timely and reflective of market conditions while incorporating refined data for improved accuracy.

5. Revenue calculation methodology

5.1 Revenue calculation for Dynamic frequency response services

Revenues from Dynamic response services are calculated based on auction results published by ESO. These include payments for providing Dynamic Containment, Dynamic Regulation, and Dynamic Moderation. Revenues are determined by multiplying the accepted service capacity by the market clearing price for each service. This revenue can be positive or negative. Performance penalties are not included, as performance monitoring data is not made publicly available.

5.2 Revenue calculation for wholesale market trades

Balancing Mechanism Units (BMUs) submit physical notifications to NESO, which are used to determine the volume component of the wholesale revenue calculation. As Modo Energy has no visibility over an asset's contracted position, it is assumed that all volume enclosed by the physical notifications of a BMU is fully contracted - i.e., the operator is buying or selling energy on the wholesale market, not at the system (or imbalance) price.

Modo Energy assumes the volume enclosed by an asset's physical notification which follows an hourly shape is traded at the arithmetic average of the N2EX and EPEX day-ahead hourly auction clearing prices. The remaining volume (that follows a half-hourly shape) is traded at the RPD HH index of the EPEX continuous market.

5.3 Revenue calculation for Balancing Mechanism actions

Assets are dispatched into the Balancing Mechanism by NESO via Bid-Offer Acceptances (BOAs). BOAs instruct assets to deviate from their physical notifications by a specified amount, over a specified period. Revenues from Balancing Mechanism actions are calculated using Bid-Offer Acceptances data, in accordance with BSC Section T, Paragraph 3.11. This revenue can be positive or negative.

5.4 Revenue calculation for Balancing Reserve and Quick Reserve services

Assets contracted into the Balancing Reserve (BR) or Quick Reserve (QR) services receive an availability payment for withholding a portion of their capacity from other markets, providing NESO with guaranteed headroom or footroom. Modo Energy collects the awarded contracts and assigns revenues to assets based on the clearing price for each settlement period and the contracted capacity of each asset. As assets are dispatched via the Balancing Mechanism, utilisation payments are included in the Balancing Mechanism revenue component.

5.5 Revenue calculation for Capacity Market contracts

Payments for assets holding Capacity Market contracts are evenly distributed across all settlement periods within the month and adjusted using monthly payment weighting factors from the Low Carbon Contracts Company, which scale payments based on demand levels throughout the year. The payments are calculated using the de-rated capacity of the Capacity Market agreement and the clearing price for that auction. Additionally, payments for T-4 contracts are adjusted for inflation using the consumer price index in accordance with Schedule 1 of the Electricity Capacity Regulations 2014.

5.6 Revenue calculation for imbalance payments

Imbalance payments are calculated using metering data published by Elexon, beginning with the first settlement run, which occurs five days after delivery. The imbalance is the difference between an asset's contracted position and its metered position, adjusted for any applicable balancing volume, and is settled at the system price.

As explained in section 3.2.2, Modo Energy does not have access to an asset’s contracted position. Therefore, we assume the volume covered by an asset's Physical Notifications (PN) is fully contracted.

For clarity, imbalance payments are calculated as:

(PN = Physical Notification, ABSVD = Applicable Balancing Services Volume Data)

ABSVD volume accounts for deviations from the contracted position from delivering applicable balancing services volume. These services include, but are not limited to, Dynamic Frequency Response and Balancing Mechanism actions. The method we follow is outlined in the ABSVD Methodology Statement, which is periodically updated by NESO.

Note that Virtual Lead Party Balancing Mechanism Units do not receive ABSVD payments, as explained by Elexon in this guidance.

5.7 Timing of Index Finalisation and Updates

Modo Energy publishes and updates Index values in line with asset inclusion reviews and Elexon’s settlement timetable, ensuring both the accuracy of revenue data and the integrity of the underlying asset set.

Asset Inclusion Finalisation

Within fifteen working days following the end of each calendar month, Modo Energy’s Research Team verifies the operational status of any newly commissioned assets. This process finalises the list of qualifying assets used in that month’s Index calculation. Assets confirmed after this window are incorporated in subsequent updates and clearly communicated to customers upon inclusion.

Settlement Runs and Data Revisions

Imbalance market revenues included in Modo Energy’s Indices are derived from settlement data published by Elexon, in accordance with the Balancing and Settlement Code (see section 5.6). This data follows a structured reconciliation process, with each Settlement Run offering progressively refined data for a given Settlement Date.

| Settlement Run | Available After Delivery | Purpose |

|---|---|---|

| II (Interim Initial) | 5 working days | Early indicative settlement values. No financial transfers are made. |

| SF (Initial Settlement) | 1 month | First formal settlement run. Used as the primary input for initial Index publication. |

| R1 / R2 / RF (Reconciliation Runs) | 2–14 months | Replaces estimated data with actuals as they become available. |

| DF (Disputes Final) | ~28 months | Performed only if a Trading Dispute is upheld. Incorporates corrected data and finalises settlement. |

Modo Energy publishes a preliminary Index value for each calendar month once II data becomes available and asset inclusion has been confirmed (see above). As Reconciliation Runs—particularly SF—are published, Index values are automatically updated to incorporate revised settlement data.

These updates are typically minor but ensure that all published values remain aligned with the most complete and accurate market data available.

6. Governance and Compliance

6.1 Transparency

Modo Energy is committed to transparency by providing detailed explanations of calculation methodologies, revenue components, and benchmark updates. All key elements of the methodology are publicly available, ensuring stakeholders can fully understand the benchmark's structure and operation. Transparency measures include:

- Publication of methodology documents outlining calculation processes and revenue components.

- Historical data updates to maintain accuracy and consistency.

- Advance notification of significant changes with a two-week consultation period.

- Documentation of stakeholder feedback and responses, available upon request by emailing team@modoenergy.com.

6.2 Stakeholder engagement

Modo Energy actively engages with stakeholders, incorporating feedback into methodology updates to improve benchmark accuracy and reliability. Engagement activities include:

- Structured consultation periods, with stakeholders given a two-week review period for proposed changes.

- Collection and evaluation of market participant feedback.

- Transparent reporting of feedback outcomes and decisions made, available upon request by emailing team@modoenergy.com.

7. Methodology changes

7.1 Review and update process

The methodology undergoes a structured review process to ensure it remains aligned with evolving market conditions and regulatory requirements. Reviews are conducted:

- Annually by the Benchmark Oversight Function;

- quarterly manual audits to assess data accuracy and consistency;

- Upon identification of material changes in market conditions or data availability.

- Direct back-testing against available transaction data is not possible due to the absence of public transactional data and the inability to independently verify the integrity of private data. Instead, validation relies on internal quality controls and market-consistent assumptions to ensure benchmark integrity.

Each review follows a documented approval process, ensuring updates are thoroughly evaluated before implementation.

7.2 Notification of changes

Significant methodology changes are communicated to stakeholders with sufficient advance notice and a clear timeline for review and feedback. The notification process includes:

- Publishing proposed changes with a detailed impact analysis.

- Allowing stakeholders a two-week consultation period to provide comments.

- Providing formal responses to stakeholder feedback and incorporating adjustments where appropriate.

- Maintaining an archive of all changes to ensure historical comparability and transparency.

8. Consistency and continuity

8.1 Quality assurance

Modo Energy employs rigorous quality assurance processes to ensure benchmark integrity. These include:

- Continuous automated validation checks to identify discrepancies.

- Quarterly manual audits to verify data sources and methodology compliance.

- Internal audits to ensure alignment with regulatory standards.

8.2 Data integrity

Data integrity is maintained through:

- Secure data management protocols, including access controls and regular backups.

- Clear traceability of all input data and calculation processes.

8.3 Handling data quality issues

Modo Energy has clear procedures in place to address instances where the quantity or quality of input data falls below the standards required for accurate and reliable benchmark determination. As all data inputs are based on publicly available sources from listed data vendors, with the exception of asset characteristics, the following approach is taken:

- Data issue verification: When data quality issues are identified, Modo Energy will confirm the issue with the data provider to verify its validity.

- Customer communication: Customers will be informed of any confirmed data issues and corrective actions taken to maintain transparency within 48 hours from confirmation.

- Data unavailability: In cases where the data provider is unable to supply the required data (e.g. missing data), Modo Energy will follow the same practice of confirming the issue and notifying customers of any impacts.

- Strict use of approved data sources: Modo Energy only utilises data from approved and listed data vendors (see section 4.2) and will not accept private or alternative data sources. Instead, recalculations and updates will be performed only once finalised data is provided by the official data vendors.

By implementing these governance and compliance measures, Modo Energy ensures that its benchmark methodology is rigorous, transparent, and resilient to market dynamics, providing reliable and accurate benchmarks under all conditions.

8.4 Traceability and verification

Modo Energy ensures all benchmark calculations are fully traceable and verifiable through:

- Maintaining comprehensive records of input data, calculation methodologies, and decision-making processes;

- and public disclosure of material changes.

By implementing these governance and compliance measures, Modo Energy ensures that its benchmark methodology is rigorous, transparent, and resilient to market dynamics, providing reliable and accurate benchmarks under all conditions.

Appendix I

Methodology changes

Methodology changes since June 1, 2021, are as follows:

| Change | Effective Date | Methodology (previous) |

Methodology (updated) |

Version |

|---|---|---|---|---|

| Wholesale trade prices | November 2022 | Nordpool day-ahead hourly price used to calculate wholesale revenues. | Average of both Nordpool day-ahead and EPEX day-ahead hourly prices used to calculate wholesale revenues. | 1.0 |

| Balancing Reserve | March 2024 | - | The Balancing Reserve service, which was launched on March 12, 2024, was incorporated into the Indices revenue components. | 1.1 |

| Capacity Market | May 2024 | - | The index was updated to include Capacity Market revenues. | 2.0 |

| Asset availability | July 2024 | Capacity Market revenues were evenly split across each settlement period on each settlement day, which occasionally led to an overestimation of asset availability (MW). | Volume weighting methodology was refined to more accurately reflect the actual battery energy storage system capacity active during each settlement date. Providing a more accurate representation of normalised revenues. | 2.1 |

| Wholesale trade prices | December 2024 | Average of both Nordpool day-ahead and EPEX day-ahead hourly prices used to calculate wholesale revenues. | The volume enclosed by an asset's physical notification which follows an hourly shape is traded at the arithmetic average of the N2EX and EPEX day-ahead hourly auction clearing prices. The remaining volume (that follows a half-hourly shape) is traded at the RPD HH index of the EPEX continuous market. | 3.0 |

| Imbalance and ABSVD payments (Balancing Mechanism Units) | December 2024 | All BM Units received ABSVD payments. | Imbalance revenue is calculated using the difference between metered and contracted volumes (assumed to be the Physical Notification), adjusted for any Applicable Balancing Services Volume Data (ABSVD), and settled at the system price. Virtual BM Units do not receive ABSVD payments. | 3.0 |

| Quick Reserve | December 2024 | - | The Quick Reserve service, which was launched on December 3, 2024, was incorporated into the Indices revenue components. | 3.0 |

Clarification updates

- 26 September 2025: Added clarification under Use of Discretion to make explicit how asset inclusion and identification (Market IDs) is applied. This does not change the calculation methodology of the ME BESS GB Indices.

Appendix II

Throughput and cycling calculations

Throughput and cycling do not influence index calculations but are displayed on the terminal to provide additional insights into battery operations.

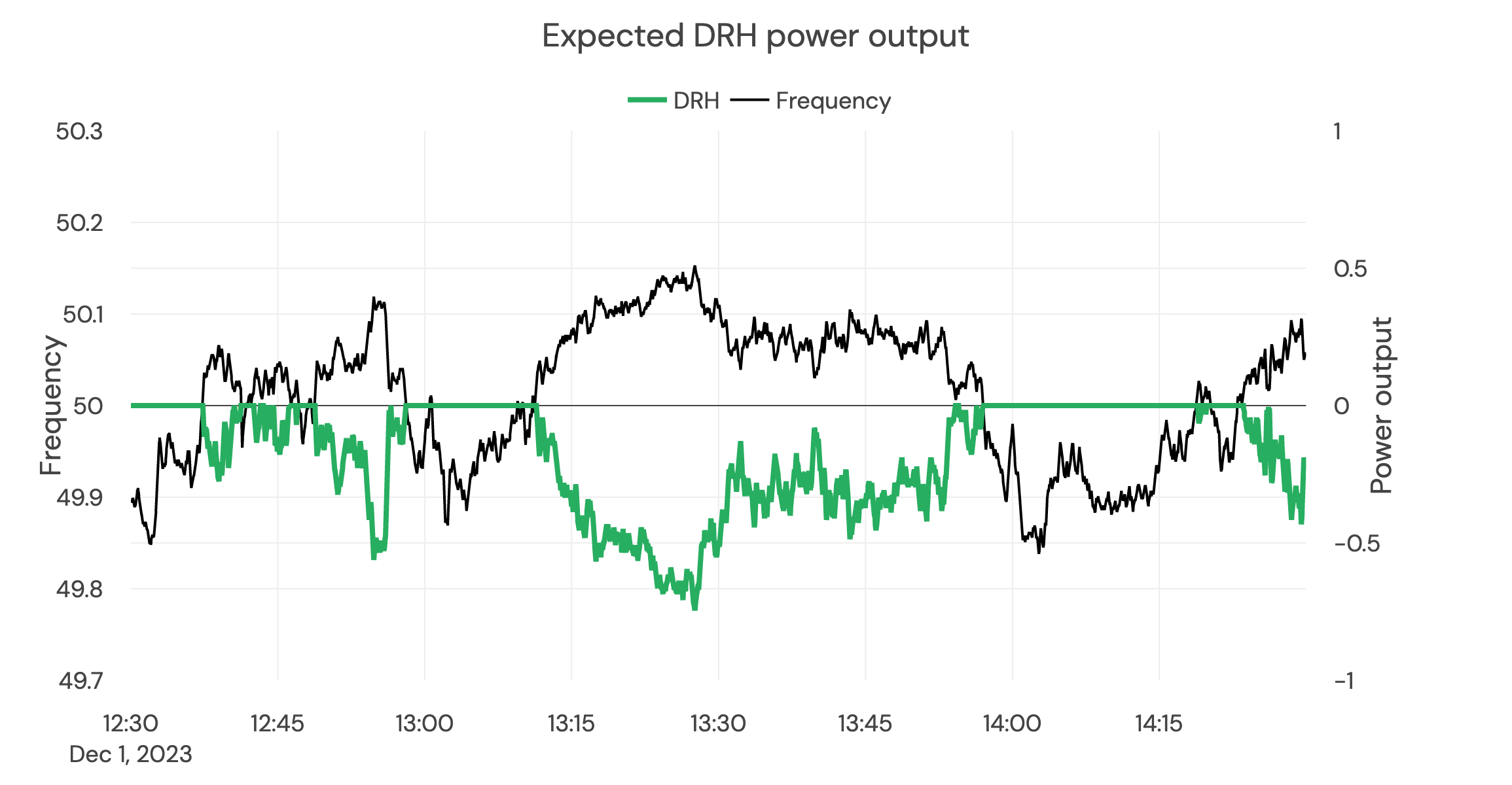

Throughput measures the energy exported by an asset during market operations. For frequency response services, throughput is determined using 1 Hz grid frequency data, which tracks the power output of an asset while delivering frequency response services. This method provides a high-resolution view of the asset's performance in response to grid fluctuations.

For balancing mechanism units (BMUs), throughput from merchant markets—including wholesale and balancing mechanism activity—is calculated by integrating the area under an asset's physical notifications (PNs) curve to estimate energy exported into the wholesale market. Additionally, the volume of energy dispatched into the balancing mechanism is summed. The total exported energy from merchant markets is derived by combining net exports across both the wholesale and balancing mechanism markets.

For non-balancing mechanism units (non-BMUs), throughput from wholesale markets is not estimated, as there is no visibility over their market activity. This limitation means non-BMU throughput calculations are based solely on available frequency response data.

Cycling measures how often an asset utilises its energy capacity over a given period. It is calculated using the formula:

Where:

- Total Energy Throughput is the total exported energy calculated as described above.

- Energy Capacity refers to the asset’s rated energy storage capacity (in MWh).

- Total Days Analysed is the period over which throughput is assessed.

Appendix III

Contracted power calculations

Contracted power does not influence index calculations but is displayed on the terminal to provide additional insights into battery asset utilisation and market participation.

Contracted power represents the average percentage of an asset's rated power that is committed to providing ancillary services. This value is determined by dividing the power contracted for frequency response by the asset’s rated power. To calculate the contracted power over longer periods, the value is multiplied by the number of settlement periods during which the asset was active in providing frequency response services.

The calculation only considers periods when the asset is actively contracted to provide frequency response services. This ensures that periods of downtime—especially for non-BMU assets, for which there is no visibility outside of frequency response contracts—are excluded from the calculation. As a result, the contracted power percentage provides a representation of an asset’s operational engagement in ancillary services across different time horizons.

Appendix IV

TNUoS Charges (Triads)

Transmission Network Use of System charges, specifically Embedded Export Tariffs, are estimated - but excluded from Modo Energy’s Index calculations. Demand charges and Embedded Export Tariff payments are levied against the energy imported or exported during Triads.

‘Triads’ refers to the three half-hour settlement periods of highest demand on Great Britain’s electricity transmission system between November and February (inclusive) each year, separated by at least ten clear days.

Demand charges and Embedded Export Tariff (EET) payments are both levied against the energy imported or exported during Triads. The Triads are the three half-hour settlement periods of highest demand on Great Britain’s electricity transmission system between November and February (inclusive) each year, separated by at least ten clear days.

Triad periods are officially confirmed in March, following the end of the winter season. Embedded Export Tariff (EET) payments are estimated using settlement metered volume data, which reflect the net energy flow for each settlement period. While EET charges are settled using gross metered volumes, this data is not publicly available.

Appendix V

Non-Balancing Mechanism Units

Whilst Non-Balancing Mechanism Units (non-BMUs) are not included in our ME BESS GB Indices, Modo Energy does provide estimates of non-BMU revenue operations in the terminal.

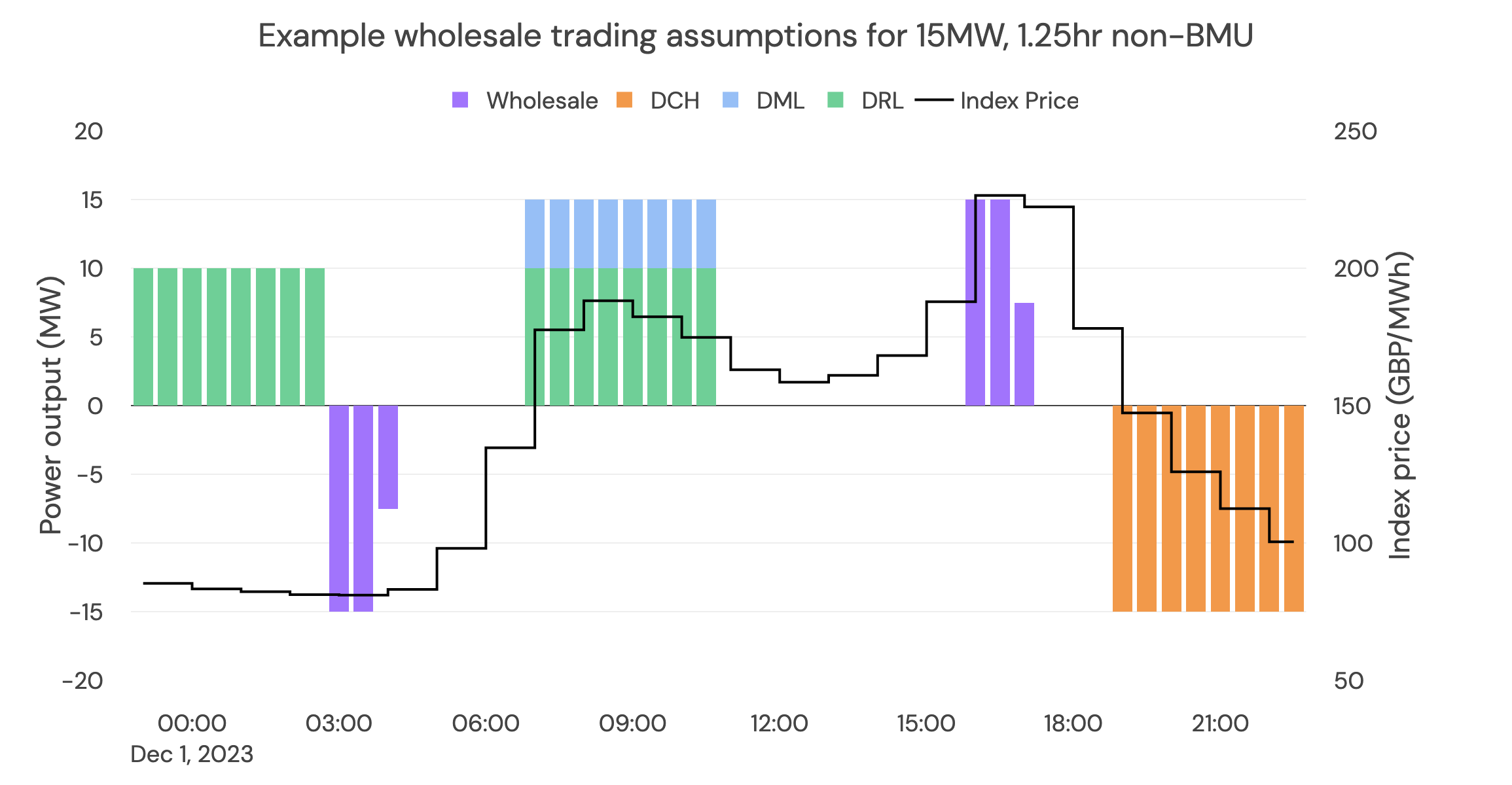

Revenue calculations for wholesale market trades

Assets that are registered as Non-Balancing Mechanism Units (non-BMUs) do not have the same data-sharing requirements as BMUs, so there is less visibility of their physical operations.

Modo Energy assumes that non-BMUs trade on the wholesale market when there is a spread of over 50 GBP/MWh in the Index Price between EFA blocks. Modo Energy assumes these trades only occur in EFA blocks where the asset is not contracted to provide frequency response (even if it is only partially contracted), and that assets do one full charge and discharge cycle in the trade. To replicate real-life inefficiencies in trading strategies, Modo Energy assumes only 70% of this revenue is captured by the asset.

As wholesale revenues are only indicative for non-BMUs, Modo Energy does not report wholesale activity below a one-month granularity. For example, a non-BMU may show wholesale revenues on the monthly Index Breakdown, but will not show wholesale activity on the asset's revenue operation chart for the same month.

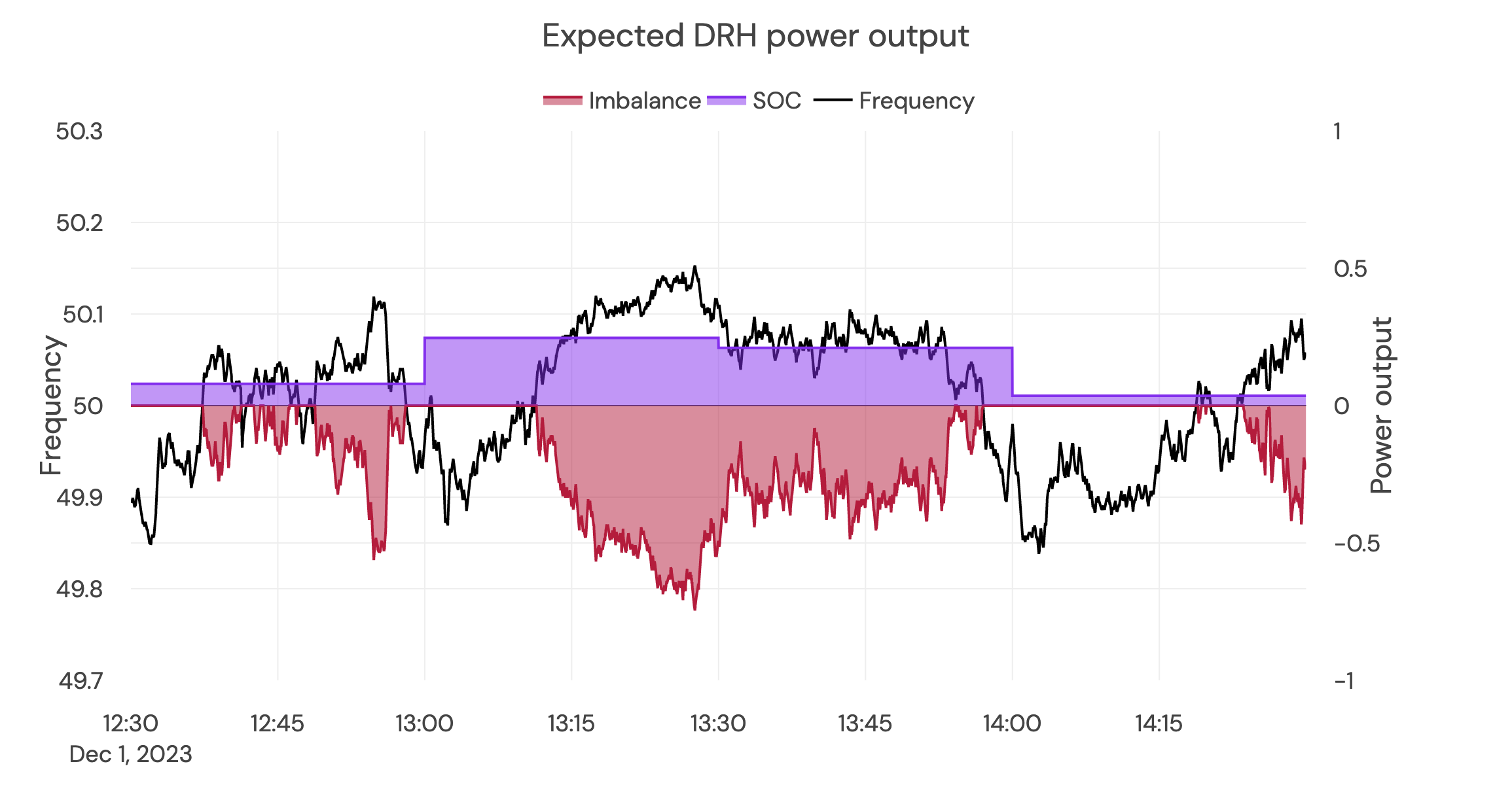

Revenue calculations for imbalance payments

By providing frequency response, batteries have to charge and discharge in response to deviations in grid frequency. This energy has to be bought or sold at the system price (also known as the imbalance, or cashout price). To calculate imbalance payments, Modo Energy estimates the volume of energy required to deliver the service by comparing against 1 Hz frequency data. As non-BMUs do not receive ABSVD payments to cover the cost of delivering frequency response services, this volume is exposed to system price. Modo Energy includes these costs as ‘imbalance’.

Revenue calculations for frequency response management

Battery energy storage systems are not perfectly efficient. Modo Energy applies an import efficiency of 85% and an export efficiency of 99% when modelling asset behaviour. These values adjust energy flows to reflect physical limitations and ensure commercial settlement aligns with actual system performance.

The frequency response action—whether importing or exporting—is treated as the known delivery. The energy required to return the asset to its original State of Charge (SoC) is calculated by applying efficiency adjustments.

High-Frequency Dynamic Response Services

In high-frequency events, assets import energy to reduce system frequency. To return to a neutral SoC:

-

Importing 1 MWh results in 0.85 MWh stored (85% efficiency).

-

Discharging this 0.85 MWh, and applying 99% export efficiency, delivers: 0.85 × 0.99 = 0.8415 MWh to the grid.

0.8415 MWh is the volume used in the imbalance settlement to reflect the energy delivered during SoC restoration.

Low-Frequency Dynamic Response Services

In low-frequency events, assets export energy to raise system frequency. To return to a neutral SoC:

-

Exporting 1 MWh to the grid requires 1.01 MWh to leave the battery (99% efficiency).

-

To recharge 1.01 MWh, and account for 85% import efficiency, the asset must import: 1.01 ÷ 0.85 = 1.188 MWh

1.188 MWh is the volume used in the imbalance settlement to reflect the energy delivered during SoC restoration.

Appendix VI

Non-Balancing Mechanism Units in custom index calculations

At Modo Energy, accuracy and transparency are central to how we calculate and report our indices. To maintain the highest standards, our standard indices are derived solely from Balancing Mechanism Units (BMUs). These assets provide a high level of operational and financial visibility due to strict data-sharing requirements, ensuring accurate and reliable representation in our calculations.

However, we recognise that asset strategies and analysis needs can vary, especially when including non-Balancing Mechanism Units (non-BMUs). To empower our users, we’ve introduced a feature allowing the inclusion of non-BMUs in custom index calculations.

What Are BMUs?

BMUs are assets registered in the Balancing Mechanism, a key part of the GB electricity market. These assets share comprehensive data on their operations, making it possible to accurately capture their performance across balancing, wholesale, and frequency response markets.

What About Non-BMUs?

Non-BMUs are active in certain markets, particularly frequency response, but do not have the same data-sharing obligations as BMUs. This often results in less visibility of their operational data, and wholesale market revenues are typically indicative rather than exact.

Considerations When Including Non-BMUs

By enabling the inclusion of non-BMUs in custom calculations, we provide flexibility for users who want a broader view of the market. However, it’s important to be aware of the potential data limitations:

- Data Gaps: Non-BMU data may be incomplete, particularly for operational visibility and wholesale revenues.

- Accuracy: Metrics for non-BMUs might rely on estimates rather than direct reports, impacting precision.

Empowering Your Analysis

Our new feature is designed to support your unique analytical needs. While BMUs remain the foundation of our standard indices for accuracy and transparency, the inclusion of non-BMUs in custom indices enables you to explore additional market dimensions, tailoring your analysis to suit your specific goals.

For further guidance or tips on using this feature effectively, feel free to reach out to our team.

Disclaimer

This document, including the methodologies and indices described herein, is the proprietary work of MODO ENERGY BENCHMARKING LIMITED (“Modo Energy”) and is provided solely for informational purposes. These indices are designed for use in financial analysis, benchmarking, and decision-making. However, they do not constitute investment advice or a recommendation regarding any specific financial instrument, asset, or strategy.

While Modo Energy strives to ensure the accuracy, reliability, and transparency of the indices and methodologies, all information is provided "as is," without any express or implied warranties, including but not limited to warranties of merchantability or fitness for a particular purpose. Users should be aware that the indices are derived from data that may be subject to revisions, delays, or inaccuracies. Past performance is not indicative of future results, and external factors such as regulatory changes, market conditions, and asset-specific characteristics may impact index performance.

Modo Energy encourages users to conduct their own due diligence and consult with qualified financial professionals before making any investment or operational decisions based on the indices or methodologies herein. Modo Energy disclaims any liability for direct, indirect, incidental, or consequential losses or damages arising from the use of the indices, methodologies, or related data.

It is not possible to invest directly in an index. Indices are intended to represent performance benchmarks, and exposure to an asset class represented by an index may be available only through separate investable instruments. Modo Energy does not sponsor, endorse, or manage any financial products that aim to track the performance of its indices.

All intellectual property rights to the indices and methodologies are owned by Modo Energy. Unauthorized use, reproduction, or redistribution of this document, in whole or part, is strictly prohibited without prior written consent from Modo Energy.

This document and the indices it describes are subject to updates and revisions. Significant changes will be communicated to stakeholders as appropriate. For further information, including licensing inquiries, please contact Modo Energy directly.

By accessing or using this document, you acknowledge and accept the terms of this disclaimer.